Global Poultry Industry and Trends

Poultry is one of the most solid and important industries in the world through the production of broilers and laying hens. The poultry market is positioned as one of the most important sectors globally due to its participation in the world’s food security and its leading role in international markets.

The world poultry market is seeking to reactivate after the COVID-19 pandemic that affected all countries in the world in 2020 and 2021. Currently, the opening of markets has favored the emergence of new connections, and the strengthening of businesses, events, and companies in the poultry sector.

Figures for the global poultry market indicate a 4.1% growth between 2021 and 2025, reaching a production of 100.9 million metric tons. Of this amount, exports are expected to be close to 13.4 million tons led by Brazil, the United States, and China.

On the other hand, the poultry market expects an increase in the prices of the various products that make up the production chain. The growing demand for these animal proteins encourages price increases, as well as the current price of feed and raw materials, which have increased in recent months at international level.

Indian poultry market, consisting of broilers and eggs was worth $25B in 2018 and projected to reach $60B by 2024, growing at a CAGR of ~16%

Poultry meat and eggs are the fastest growing food segments in India (driven by increase in consumption per capita, rise of quick service restaurant, population growth and ban on cow meat in some states etc.). India is 3rd biggest poultry producer however more than 90% of chicken is unprocessed (live chicken). However, this trend is changing as processed chicken market is expanding rapidly at 15% CAGR with rise of QSRs (Quick Service Restaurants like KFCs) and online meat delivery platforms (Licious, Zappfresh, Bigbasket, Grofers etc.).

Opportunities exist across the value chain in poultry and eggs – specially across building consumer brands in processed chicken and eggs category

India has one of the highest feed cost per kg of broiler (Not a cost competitive market despite low labor cost) due to low yields of corn, soy, millet and other ingredients as well as high import duties on raw feed products. Opportunities exist in increasing the yield of these crops and creatively improving mix with relatively lower cos In poultry production, opportunities are more geography based. Most of the supply comes from Andhra Pradesh, Telangana, Haryana and Punjab. In some of the most populous states like UP, Bihar and West Bengal, local poultry production (hatchery, layer and broiler) is low despite high demand. This could mean a big opportunity for local poultry producers in these states.

Finally, I think the biggest opportunity lies in building consumer brands in this segment. As mentioned above the demand for processed chicken is on the rise. However, most of the online platforms haven’t build their own supply chain and are completely dependent on their partners to provide consistent quality meat and eggs. This is where the gap exists in the value chain as most of these vendors lack dry processing, storage, cold chain facilities and logistical (refrigerated trucks or specialized equipment) for packing and transporting produce.

New age entrepreneurs (Entrepreneurship through acquisition or VC/PE fund route) can fill these gaps in a high growth market.

Consumers today miss a reliable chicken brand that they can trust for quality and freshness and where chickens have been raised using no artificial means. Further, frozen processed meat market is also picking up and there is an opportunity to export high value products (eggs powder, shakes etc.) in select markets. Integrated players (Like Venky’s, Suguna and others) who have full control on the supply chain have advantage to fill this gap but they haven’t really done much in this space yet apart from a few investments (Venky’s launched into QSR space in 2010 but a lot more is desired). New age consumer brands (led by digital channel) focused on this market segment can do well given the high penetration of internet and leveraging online grocery platforms (Amazon, Big Basket etc.).

The poultry sector, which has an extremely important place in terms of food safety and nutrition, is the fastest growing agricultural sub-sector, especially in developing countries. It is thought that factors such as population growth, income level growth, and urbanization will contribute to the growth of the sector in the future. The poultry sector, which has a market value of $ 310.7 billion in 2020, is expected to grow to $ 322.55 billion in 2021 and record at compound annual growth rate (CAGR) of 3.8%. The market is expected to hit $ 422.97 billion in 2025 with a CAGR of 7%.

The most important segment of the livestock industry is the poultry sector. An extremely complicated industry in itself, the poultry sector consists of many different levels of production, including feed factories, hatcheries, breeding farms, and processing plants. Likewise, there are sub-units such as chicken, duck, turkey, and goose in terms of species in the sector. The sub-classes for production are divided into meat and egg production. Production for feathers can also be added to this.

Among poultry species, chicken is the main breeding area around the world and, according to estimates, represents more than 90 percent of the poultry sector. Other species include duck in Asia, turkey in North America, guineafowl in Africa, and geese are also known as prominent species after chicken breeding.

The poultry sector, which has an extremely important place in terms of food safety and nutrition, is the fastest growing agricultural sub-sector, especially in developing countries. It is thought that factors such as population growth, income level growth, and urbanization will contribute to the growth of the sector in the future. Although small farms and family businesses in the sector have been instrumental in the growth of the market, it seems that the main growth will be due to large-scale operations.

Although these developments contribute to the growth momentum of the market, some problems that have a negative impact also stand out as obstacles to the sector. One of these problems is the role of poultry in infectious diseases. Besides, the risks they pose to human health due to antimicrobial resistance are also seen as a significant problem. In recent years, intensive studies have been carried out on antibiotic-free production options, especially due to the antimicrobial resistance problem, and countries are trying to create a driving force on producers in terms of antibiotic-free production with various regulations.

PRESENCE OF POULTRY

According to data from the United Nations Food and Agriculture Organization (FAO), the total poultry presence in the world (chicken, duck, goose, guineafowl, and turkey) is about 27.9 billion heads in 2019. The largest share of this presence belongs to by chickens, with about 93 percent. The number of chickens worldwide has more than doubled since 1990, according to the FAO. The number of chickens, which was 14.38 billion in 2000, reached 25.9 billion in 2019. The largest share of this presence belongs to Asian countries. In the same period, the total chicken presence in Asia was 15.8 billion. It is followed by the Americas with 5.8 billion. The chicken presence in Africa and Europe is about 2 billion each.

Other poultry presences in 2019 are as follows; duck 1.2 billion, goose and guineafowl 362 million, turkey 428 million.

POULTRY MEAT PRODUCTION

Poultry meat stands out as the most widely produced type of meat in recent years. According to FAO data, 40.6 percent of total meat production, which is 337.3 million tons in 2020, belongs to the poultry group. The FAO’s “MEAT MARKET REVIEW – Emerging trends and outlook” report, published in December 2020, also states that demand for alternative meats is driving growth in poultry meat production and trade. Because chicken meat for consumers is more purchasable in terms of price compared to other meats. This, in turn, leads to gradual effects on the poultry market, from production to trade. For example, poultry meat production, which was 127.3 million tons in 2018, reached 133.6 million tons in 2019. But in 2020, due to Covid-19, the closure of mass food outlets such as restaurants, the introduction of certain production procedures, and an outbreak of avian flu led to lower-than-expected growth. According to FAO estimates, the total production of poultry meat in the world in 2020 increased by 2.6 percent to 137 million tons. This amounts to almost half the growth rate in 2019.

In 2020, due to Covid-19, the closure of mass food outlets such as restaurants, the introduction of certain production procedures, and an outbreak of avian flu led to lower-than-expected growth. According to FAO estimates, the total production of poultry meat in the world in 2020 increased by 2.6 percent to 137 million tons. This amounts to almost half the growth rate in 2019.

China, the US, Brazil, South Africa, and Mexico are thought to have the largest share of production growth in 2020. In contrast to these countries, India and the European Union are estimated to be in decline. If we look at the details, production in China is estimated to have increased by about 12 percent to 26 million tons due to significant investment; likewise, there is an increase in production in America, which corresponds to an annual growth rate of 1.6 percent. Production in Brazil is thought to have continued to increase, albeit at a slower pace than in the previous three years. In the same way, poultry meat production in Mexico is expected to increase. In South Africa, poultry production is estimated to have increased by 8 percent to around 1.9 million tonnes in the 2019/20 season, helped by a historic record-breaking corn harvest and low feed costs. In India, it is believed that poultry production will decline by 10 percent in 2020 due to the Covid 19 pandemic in production areas and restrictions imposed. The European Union is also experiencing a decline of about 1.6 percent due to declining foodservice sales, school closures, and shrinking tourism revenues, with production estimated at 14 million tonnes.

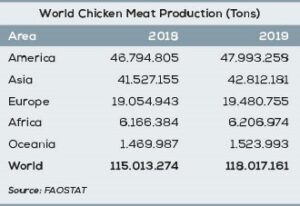

Looking at the data specific to chicken meat, it is seen that the production of chicken meat, which was 115 million tons in 2018, reached 118 million tons in 2019. The largest share in chicken meat production belongs to the countries of the Americas with a production amount of 47.9 million tons in 2019. In the same year, America is followed by Asia with 42.8 million tons, Europe with 19.4 million tons, and Africa with 6.2 million tons.

In 2020, the United States has the highest volume of chicken meat production among all countries, producing about 20.5 million tons of chicken meat. During the same period, China ranked second with 15 million tons, while Brazil ranked third with 13.7 million tons of production.

EGG PRODUCTION

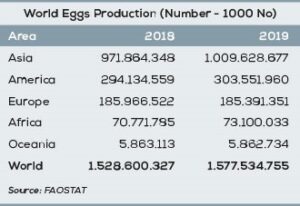

According to FAO data, total egg production in the world amounted to 1.528 billion units in 2018. In 2019, this figure reached 1.577 billion. The largest share of production in 2019 (almost 64 percent of total production) belongs to Asian countries. China has a huge share of production in the region. Because with a production figure of 576 billion in 2019, China is the country that produces the most eggs on a global scale.

Asia is followed by the Americas with 303 billion. The United States, which occupies an important place in egg production, produced only 113 billion eggs during the same period as the continent’s largest producer. America is followed by Europe with 185 billion and Africa with 73 billion.

POULTRY FEED PRODUCTION

The poultry group ranks first based on species in global feed production. According to the Alltech Global Feed Survey 2021 report, the production of broiler chicken feed, which was 332.5 million tons in 2019, reached 334.5 million tons in 2020, with an increase of 1 percent.

The share of broiler chicken feeds from global feed production is 28.2 percent. 143.6 million tons of this production is carried out by the Asia-Pacific region. The Asia-Pacific region, which produced 141.1 million tons of broiler chicken feed in 2019, increased this amount to 143.6 million tons in 2020. In 2020, the Asia Pacific region is followed by Latin America with 62 million tons, Europe with 54.8 million tons, North America with 50.9 million tons, Africa with 11.1 million tons, and the Middle East with 8.1 million tons.

Egg feed production has been around 160 million tons for the last 2 years. In this group, the largest production region is again Asia-Pacific. The Asia-Pacific region, which produced 75 million tons of egg feed in 2019, increased its production to 77.9 million tons in 2020. In 2020, the Asia-Pacific region in egg feed is followed by Europe with 31.1 million tons, Latin America with 23.1 million tons, and North America with 15.1 million tons.

CONSUMPTION RATES

According to the report “World – Poultry – Market Analysis, Forecast, Size, Trends and Insights” prepared by IndexBox, global consumption in the poultry industry peaked in 2019 and will continue to grow in the near future. Among the countries with the highest poultry consumption in 2019, China is seen as ranking the first with 20 million tons. It is followed by the United States with 19 million tons, Brazil with 12 million tons. The three countries represent about 40 percent of global consumption. These countries are followed by Russia, Mexico, India, Japan, Indonesia, Iran, South Africa, Malaysia, and Myanmar. The share of these countries in consumption is around 21 percent.

Malaysia has the highest share of poultry consumption per capita in 2019 with 63 kilograms. This country is followed by the United States with 58 kilograms and Brazil with 57 kilograms. Among the leading consumer countries from 2009 to 2019, Myanmar achieved the most remarkable growth rate in terms of poultry consumption per capita, while for other global leaders, poultry consumption per capita showed much more modest growth.

EXPORTS AND IMPORTS

According to the IndexBox report, global poultry shipments increased 2.2 percent to 17 million tons in 2019. Total trade volume in the industry grew at an average annual rate of 3.3 percent in the period from 2009 to 2019. In terms of value, poultry exports rose to $ 27.3 billion in 2019. During the reviewed period, global exports reached a maximum of $ 28.5 billion in 2014; however, exports from 2015 to 2019 remained at a lower figure.

FAO’s data for 2019 indicates exports of poultry meat of 15.7 million tons. The value of these exports is 25.7 billion dollars. During the same period, 1.9 billion head of poultry exports were carried out as live animals. The value of these exports is 3.1 billion dollars.

According to the IndexBox report, Brazil ranks first in global poultry exports with 4 million tons in 2019, accounting for about 24 percent of total exports. It is followed by the US with 3.6 million tonnes. The share of the US in total exports is about 22 percent. Brazil and the United States are followed by the Netherlands with 1.5 million tons and Poland with 1.5 million tons. The share of these two countries in total exports is about 18 percent. The export amounts of other countries are as follows: Belgium 509 thousand tons, Turkey 493 thousand tons, Germany 473 thousand tons, France 398 thousand tons, Ukraine 361 thousand tons, United Kingdom 359 thousand tons, Hong Kong 328 thousand tons, and Thailand 295 thousand tons.

Egg exports amounted to 2.3 million tons in 2019 according to FAO data. The value of these exports is 3.5 billion dollars.

MARKET VOLUME AND GROWTH EXPECTATIONS

The poultry sector, which has a market value of $ 310.7 billion in 2020, is expected to grow to $ 322.55 billion in 2021 and show a compound annual growth rate (CAGR) of 3.8 percent according to the “Poultry Global Market Report 2021: COVID 19 Impact and Recovery to 2030” report published by Reportlinker in January. The market is expected to reach $ 422.97 billion in 2025 with a compound annual growth rate of 7%.

Growth in 2021 will be driven by companies that have survived the COVID-19 impact and reorganized their operations. The Covid-19 pandemic had caused the sector to go through a difficult process due to restrictions such as social distance, remote work, operational difficulties, and discontinued commercial activities.

Compiled & Shared by- This paper is a compilation of groupwork provided by the Team, LITD (Livestock Institute of Training & Development)

Image-Courtesy-Google

Reference-On Request