An Overview of the Indian Meat Industry

Hari Ram Meena*1, L. Gautam2 and R. K. Nagda3

Department of Animal Genetics & Breeding

College of Veterinary & Animal Science, Navania, Udaipur

Rajasthan University of Veterinary & Animal Sciences, Bikaner (Raj.)

*1 PG Scholar (Animal Genetics & Breeding)

Abstract

India has the largest livestock population throughout the country. In 20th Livestock Census, the total Livestock population is 536.76 million in the country in which there are about 36.04%-Cattle, 27.74%-Goat, 20.47%-Buffaloes, 13.83%-Sheep, 1.69%-Pigs, and Mithun, Yaks, Horses, Ponies, Mules, Donkeys and Camels taken together contribute 0.23% of the total livestock. India is the largest exporter of buffalo meat and third largest exporter of meat after Brazil & Australia. There are many constraints for the slow growth of the Indian meat industry, including lack of scientific approach to rearing of meat animals, unorganized nature of meat production and marketing, socio-economic taboo and inadequate infrastructure facilities and poor harvest management. Meat exports from India commenced in 1969. For over four decades, it has built an enviable reputation of being a reliable exporter of risk-free, lean, nutritious and competitively priced meat. This has led to consistent, high compound growth rate in the export volumes. Among the important buyers of Indian bovine and other meat are Vietnam, Malaysia, Thailand, Australia, UAE, Saudi Arabia and Egypt. India exports both frozen and fresh chilled meat. Among Indian states, Uttar Pradesh (UP) has emerged as the major exporter of buffalo meat, followed by Punjab and Maharashtra. Besides having the country’s largest buffalo population, U P also has the highest number of abattoirs cum meat processing export units.

Introduction

Meat is the flesh of an animal that people all over the world consume. People around the world eat different amounts of meat based on their culture, religion, and income situation. In developing countries, where meat and milk production is expected to rise the most over the next few decades, the livestock industry is on the doorstep of a change. Livestock production is an important part of life in rural areas because it gives farmers employment opportunities, a way to make a living and money. It also provides nutrients like fat, protein, carbohydrates, and vitamins to people who are poor or weak in rural areas. Animal-based proteins are 90–97% digestible, while plant-based proteins are 75–99% digestible. Proteins from animals, on the other hand, are better for you nutritionally and are digested more thoroughly than proteins from plants. People have been hunting and killing animals for food since ancient times (John, 2013). When people started living in groups, they were able to tame animals like chickens, sheep, pigs, and cattle and finally use them to make meat on a huge scale.

Meat is mostly water and fat, but it also has a lot of protein, vitamins, and minerals, like iron, selenium, zinc, and vitamin B-complex. Most people eat it with other foods. It is one of the best places to get vitamin B12. It can be eaten raw, but most people eat it after cooking it and flavoring it or processing it in different ways. Meat that hasn’t been processed will go bad in hours or days because bacteria and fungus will infect it and break it down (Truswell, 2002). Around the world, there is a huge rise in demand for food that comes from animals. This is caused by more people living in cities, changing lifestyles, and higher incomes per person.

As per World Bank projection, worldwide demand for food will increase by 50% and for meat by 85% by 2030. Long-term policies and investments must be made by governments and businesses to meet the country’s growing demand for meat. This will help meet rising customer demand, improve nutrition, create jobs, and reduce environmental stress.

The Indian government already knows that raising poultry and livestock is a key part of the country’s economic and social growth. The National Meat and Poultry Processing Board (NMPPB) was set up in New Delhi by the Ministry of Food Processing Industries (MFPI) to help the meat industry grow in a healthy and organized way so that clean and healthy meat can be produced. Also, the Food Safety and Standards Act of 2006 makes sure that the processed meat industry makes safe, high-quality goods that meet the standards of international trade. This helps the Indian food and meat industry compete on the world market. The Indian meat industry is growing slowly because there isn’t a scientific way to raise animals for meat, the production and selling of meat isn’t organized, there are social and economic taboos, the industry doesn’t have the right infrastructure, and harvest management isn’t done well. India has been through the green, white, yellow, and blue revolutions in the last thirty to forty years. Now it’s time for the red revolution, which will happen in the form of meat production.

Key features of meat production

Meat production

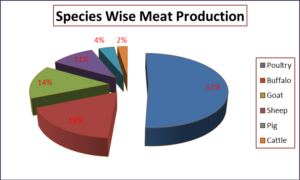

According to the 20th Livestock Census, the country maintains the world’s highest livestock population of approximately 536.76 million. In this context, meat production is an important component of the Indian agricultural system. According to Animal Husbandry Statistics 2023, meat production in India is estimated at 9.77 million tons annually with an annual growth rate 5.62 per cent and is ranked 8th in the world in terms of production volume. Carabeef meat accounts for 36% of total meat production, followed by goat (30%), sheep (21%), pig (8%), and cow (5%), when chicken meat is excluded. India is the largest producer of Carabeef and second largest producer of chevon meat. Poultry meat production, on the other hand, is over 5 million tons, accounting for nearly 51.44 percent of total meat production. Uttar Pradesh produces the most meat in India, accounting for 12.2% of total meat production, followed by West Bengal (11.9%), Maharashtra (11.5%), Andhra Pradesh (11.2%), and Telangana (11%). India is responsible for 3% of the total meat production in the world. (BAHS 2023)

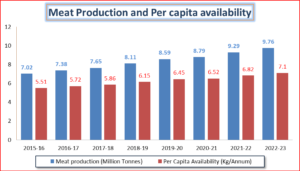

Per Capita Availability

Almost 70% of the Indian population is non-vegetarian. In India, per capita meat consumption is around 7.10kg per year during 2022-23, increasing 0.28 kg/Annam from the preceding year. However, the ICMR recommends 12.5kg per year for each person. Chicken and fish have the highest consumption rate. The consumption of poultry meat in India was over 4.9 million metric tons in 2022-23.

Meat Production and Per capita availability (India) (BAHS 2023)

Species wise Meat production (India) (BAHS 2023)

| Species | Percent Slaughter

Animals |

Meat production

(Million tones’) |

Species Contribution |

| Poultry | 93.72% | 5.00 | 51.44 % |

| Buffalo | 0.38% | 1.72 | 17.49 % |

| Goat | 3.49% | 1.41 | 13.63 % |

| Sheep | 2.08% | 1.03 | 10.33 % |

| Pig | 0.26% | 0.38 | 3.93 % |

| Cattle | 0.06% | 0.24 | 3.18 % |

Components of meat industries

The meat and meat by-product industries involve various components, each playing a crucial role in the overall production, processing, and distribution of meat products, it included:

- Livestock Farming:

- Breeding: Involves the selective mating of animals to improve specific traits such as meat quality, growth rate, and disease resistance.

- Raising: Involves the care, feeding, and management of animals to ensure optimal growth and health.

- Slaughterhouses/Abattoirs:

- Slaughtering: Slaughtering the animals by trained & skilled butchers for retail in domestic Slaughtering the animals in the modern abattoirs in export oriented units for exports.

- Processing: Includes the initial steps of carcass preparation, such as skinning, evisceration, and initial cutting.

- Meat Processing Plants:

- Further Processing: Involves additional steps like cutting, curing, smoking, and cooking to produce various meat products.

- Preparation of ready to-eat products:

- Restructured meat products

- Emulsion based meat products

- Shelf stable meat products

- Fermented meat products

- Traditional meat products

- Extruded meat products

- Health oriented or Functional meat products

-

- Packaging: Packaging and labeling of meat products for distribution.

- Rendering: Converts meat by-products (such as bones, fat, and offal) into valuable products like tallow, bone meal, and protein meal.

- Production of pet foods.

- Retail marketing and food services:

- Butchers: Local butchers or meat markets that sell fresh cuts of meat.

- Supermarkets: Large retail stores that offer a variety of packaged meat products.

- Food Service: Includes restaurants, cafeterias, and other establishments that serve meat dishes to consumers. Marketing: Promoting meat products to consumers through advertising and branding.

- Education: Providing information on nutritional value, cooking methods, and sustainability to consumers.

- Research and Technology Development:

- Product Development: Involves creating new meat products, improving existing ones, and exploring innovative processing techniques.

- By-Product Utilization: Finding sustainable and environmentally friendly ways to handle waste generated in the meat processing industry.

- Processing Equipment: Machinery used in the various stages of meat production and processing.

- Information Technology: Systems for inventory management, traceability, and quality control.

- Regulatory and Quality Assurance:

- Inspection: Ensuring that meat products meet safety and quality standards.

- Compliance: Adhering to regulations related to food safety, labeling, and animal welfare.

- Transporting and Export:

- Logistics: Involves the transportation and distribution of meat products to retailers, wholesalers, and other points of sale.

- International Trade: Involves the import and export of meat products, subject to various regulations and standards.

These components together make up a complex and interconnected network within the meat and meat by-product industries. The success and sustainability of the industry depend on effective collaboration and adherence to ethical, environmental, and health standards.

Potential of meat industry

- India is having a good potential for meat production because of large livestock population in global world.

- About 20.5 million people depend upon livestock for their livelihood.

- Livestock contributed 16% to the income of small farm households as against an average of 14% for all rural households.

- Livestock provides livelihood to two-third of rural community.

- It also provides employment to about 8.8 % of the population in India. India has vast livestock resources.

- Livestock sector contributes 4.11% GDP and 25.6% of total Agriculture GDP.

Export potential:-

- The meat industry is slowly yet steadily catching pace on the global front also as India exports both frozen and fresh chilled meat to more than 60 countries of the world.

- Meat exported from India is risk-free, lean, nutritious and competitively priced meat.

- It has resulted in consistent, high compound growth rate in the export volumes.

- The major item of export includes de-boned and de-glanded frozen buffalo meat, which accounts for 78.65 per cent of the total meat export.

- India is the largest exporter of sheep and goat meat to the world (APEDA, 2021).

- The major market for Indian buffalo meat is Malaysia and Egypt and for sheep and goat meat are UAE, Iran and Jordan.

- India also exports a small quantity of processed meat to Thailand, Yemen, and Japan and poultry products to Saudi Arabia, Oman, Kuwait and Qatar.

- Uttar Pradesh state has emerged as the major exporter of buffalo meat followed by Punjab and Maharashtra.

- The value addition to slaughterhouse by products generate additional income as well as the costs of disposing of by products can be minimized.

- There is huge potential in this sector for economic development of country through increasing exports so the policy makers should adopt critical measures at every stage to encourage and support this vital segment of the Indian agriculture.

Manufacturing and Marketing Players

Many major players involve in manufacturing and marketing of processed meat and meat products in India are:

- The Meat Products of India Ltd. (MPI)

- Venky’s Exports Pvt. Ltd.

- Al Kabeer Exports Pvt. Ltd.

- Nippon Meat Packers India Pvt. Ltd.

- Allanasons Private Limited

- Amrit Group

- Suguna Foods Private Limited

- Charoen Pokphand Group

- Zydus Wellness Ltd.

- Innovative Food Limited

- IB Group

- Apex Frozen Foods Limited

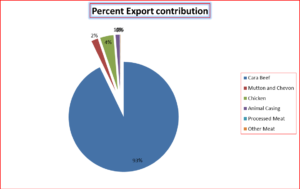

Agricultural and Processed Products Exports Development Authority (APEDA)

India possesses a varied meat sector, with exports of Animal Meat Products amounting to Rs. 27,621.57 Crores (2022-23). The majority of income from meat exports in India, around 93%, is derived from Carabeef, followed by chicken (4%), mutton and chevon (2%), and other processed meat (2%). Carabeef has played a substantial role in the nation’s overall meat exports. This suggests a significant dependence on buffalo meat in the international export industry.

| Meat & Meat Products | Exports (Rs. Crore) | Per cent Revenue Export |

| Cara Beef | 25648.1 | 92.86 |

| Mutton and Chevon | 537.18 | 1.94 |

| Chicken | 1081.62 | 3.92 |

| Animal Casing | 326.02 | 1.18 |

| Processed Meat | 11.72 | 0.04 |

| Other Meat | 16.93 | 0.06 |

Constraints of Meat Industries

The Indian meat industry encounters numerous problems and vulnerabilities, stemming from a variety of variables. To rectify these deficiencies, a comprehensive strategy incorporating enhancements in infrastructure, regulatory frameworks, technology implementation, and sustainable practices within the meat sector would be necessary. It is crucial to acknowledge that these issues may differ among various parts of the country. Several weaknesses include:

- Inadequate Infrastructures and Supply Chain Issues:

- The meat industry suffers from inadequate infrastructure, including outdated processing facilities, lack of modern slaughterhouses, and inefficient cold storage and transportation systems.

- Lack of modern and efficient supply chain infrastructure can lead to spoilage and wastage of meat products.

- Inefficient cold storage and transportation facilities can affect the quality and safety of meat.

- Low productivity, Quality and Safety standards:

- Traditional methods of rearing livestock and processing meat often result in lower productivity and inconsistent quality. Adoption of modern practices is hindered by factors such as lack of awareness and resistance to change.

- Inconsistent quality standards and poor hygiene practices at various stages of production and distribution can result in safety concerns for consumers.

- Inadequate regulatory frameworks and enforcement can contribute to the prevalence of unhygienic practices.

- Environment and Regulatory Challenges:

- The meat industry is often criticized for its environmental impact, including deforestation, water usage, and greenhouse gas emissions. Sustainable and eco-friendly practices are not widespread.

- Stringent and often complex regulatory frameworks can pose challenges for the meat industry. Compliance with various regulations related to hygiene, safety, and environmental standards can be demanding for smaller businesses.

- Disease Outbreaks:

- The industry is vulnerable to outbreaks of animal diseases, which can lead to culling and loss of livestock. Diseases can also affect the reputation of the industry in terms of food safety.

- Lack of Modernization:

- Many players in the industry operate on a small scale, limiting economies of scale and making it difficult to implement modern and efficient production processes.

- Many meat processing units in India still use outdated and traditional methods, hindering efficiency, productivity, and quality improvement.

- Limited adoption of modern technologies for processing and packaging.

- The meat sector is experiencing a deficiency in trained workforce, namely in areas such as meat processing, quality control, and veterinary services.

-

- Insufficient investment in research and development in the meat industry hampers the adoption of new technologies, breeds, and practices.

- Cultural and Religious Sensitivities:

- India is a diverse country with a variety of cultural and religious beliefs. This diversity can pose challenges for the meat industry, as certain communities abstain from consuming specific types of meat.

- Market Access and Export Challenges:

- Difficulty in accessing markets due to regulatory barriers and lack of proper distribution channels can hinder the growth of the industry.

- Meeting international quality and safety standards for export can be a challenge, limiting the industry’s potential in the global market.

- Exporting meat products from India faces challenges due to stringent standards imposed by importing countries. Meeting these standards and addressing trade barriers can be a constraint for the industry’s global expansion.

Opportunity in Meat Industries

India, with its large and diverse population, significant livestock numbers, and a growing consumer market, presents substantial opportunities in the meat industry. Here are some key points elaborating on the opportunities in the Indian meat industry:

- Population Size and Consumption Patterns: India’s massive population, which is the world’s largest, contributes to a substantial domestic market for meat products. As incomes rise and dietary preferences change, there is an increasing demand for protein-rich food, including meat products. This demographic shift contributes to the diversification of the market and the demand for high-quality, processed meat and value added offering.

- Livestock Potential: India provides the world’s largest livestock population, which includes cattle, buffalo, poultry, goats, and sheep. This abundance of livestock ensures a consistent supply of meat for domestic use as well as prospective export markets.

- Urbanization and Economic growth: India’s increasing urbanization and economic progress have brought about changes in eating habits and lifestyle. Particularly in urban areas, customers have a greater preference for processed and convenience foods, which presents prospects for domestic and foreign companies operating in the meat processing sector.

- Government initiatives with Export Potential: The Indian government has started a number of programs to encourage the export of livestock products. Schemes aimed at improving animal husbandry practices; modernizing meat processing facilities with improvements in infrastructure, quality standards, and adherence to international regulations contribute to the meat industry’s potential to tap into global markets, with the primary role being a significant revenue stream for the industry.

- Technology Adoption and Modernization: The adoption of modern technologies in meat processing, including refrigeration, cold chain logistics, and processing techniques, can enhance the quality and safety of meat products. This provides an opportunity for businesses to invest in technology to improve efficiency and meet quality standards.

- Export Opportunities: India has the potential to become a significant player in the global meat market. Meeting international standards and certifications could open up export opportunities for Indian meat products, especially in countries with high demand for diverse meat offerings.

- Diversification of Meat Products: Consumer preferences are evolving, leading to increased demand for a variety of meat products, including processed and value-added items. Businesses that can innovate and diversify their product offerings may find success in this dynamic market.

- Investment Opportunities: Given the potential for growth in the meat industry, there are opportunities for both domestic and foreign investors to participate in the expansion and modernization of the sector.

- Environmental and Health Considerations: With an increasing awareness of environmental sustainability and health considerations, there is a growing market for alternative meat products, such as plant-based and lab-grown meats. Companies exploring these alternatives could find opportunities in the changing market landscape.

Challenges

- Productivity of farm animals:

- It is one of the major challenges.

- The average annual milk yield of Indian cattle is 1172 kg which is only about 50 per cent of the global average.

- Diseases and infections of livestock:

- The frequent outbreak of infections like the foot and mouth disease, black quarter infection, and influenza severely impacts livestock health and lowers productivity.

- Feed & Fodder issues:

- Livestock derives a major part of their energy requirement from agricultural by-products and residues. Hardly 5% of the cropped area is utilized to grow fodder. India is deficit in dry fodder by 11%, green fodder by 35% and concentrates feed by 28%. The common grazing lands too have been deteriorating quantitatively and qualitatively.

- Greenhouse gas generation:

- The generation of greenhouse gases by the humongous population of herbivorous animals in India.

- Reducing the emissions through mitigation and adaptation strategies is a major challenge.

- Breeding issues:

- Crossbreeding of indigenous species with exotic stocks to enhance the genetic potential of different species has been successful only to a limited extent.

- Crossbreeding of indigenous species with exotic stocks to enhance genetic potential of different species has been successful only to a limited extent.

- Limited Artificial Insemination services owing to a deficiency in quality germplasm, infrastructure and technical manpower coupled with poor conception rate following artificial insemination have been the major impediments.

- Health and occupational hazards:

- Unregulated meat markets, tropical climate, inadequate slaughterhouse hygiene measures, and the lack of surveillance of meat-borne diseases enhance the risk of health-related and occupational hazards.

- According to reports, there are about 8000 registered and more than 20,000 unregistered slaughterhouses in the country and most of them are devoid of basic amenities like light and ventilation.

- Moreover, the slaughtering and carcass-dressing processes are performed in open areas in highly unhygienic conditions following which the meat is sold with little or no veterinary inspection.

- Unorganized sector:

- The meat production segment is largely unorganized. Traditional production systems and disorderly practices have spoilt the reputation of the Indian meat industry.

- Except for poultry products and to some extent for milk, markets for livestock and livestock products are underdeveloped, irregular, uncertain and lack transparency. Further, these are often dominated by informal market intermediaries who exploit the producers.

- Slaughtering facilities are too inadequate:

- About half of the total meat production comes from un-registered, make-shift slaughterhouses. Marketing and transaction costs of livestock products are high taking 15-20% of the sale price.

- Financial issues:

- Livestock sector did not receive the policy and financial attention it deserved. The sector received only about 12% of the total public expenditure on agriculture and allied sectors, which is disproportionately lesser than its contribution to agricultural GDP.

- The sector has been neglected by the financial institutions.

- The share of livestock in the total agricultural credit has hardly ever exceeded 4% in the total (short-term, medium-term and long-term). The institutional mechanisms to protect animals against risk are not strong enough.

- Insurance:

- Currently, only 6% of the animal heads (excluding poultry) are provided insurance cover. Livestock extension has remained grossly neglected in the past.

- Only about 5% of the farm households in India access information on livestock technology. These indicate an apathetic outreach of the financial and information delivery systems.

Measures needed

- A national breeding policy is needed to upgrade the best performing indigenous breeds.

- Measures should be taken to increase the meat production efficiency of different species of animals using the improved management practices.

- Adoption of improved shelter management practices can reduce the environmental stress.

- New breeds should be developed for meat production with higher feed conversion efficiency, faster growth and disease resistant.

- Health management practices should be followed for prevention of diseases and economic loss to the farmers.

- Regular prophetic health measures should be carried out against infectious diseases.

- Regular screening of animals should be carried out against disease such as tuberculosis, brucellosis, salmonellosis etc.

- The livestock market yard should have basic facilities for feeding, watering and holding animals for days.

- By vertical integration with meat processing industries the middle men can be eliminated, which will ultimately increase the profit of farmers.

- There is need for modernizing the quality control laboratories of the State Government, apart from need for strict laboratory inspection of meat and meat products, training programs for meat workers regarding hygiene and sanitation need to be organized regularly.

- Modernization of abattoirs, setting up of rural abattoirs and registration of all slaughter houses in cities/towns are essential for quality meat production.

- The setting up of large commercial meat farms have been recommended to address the traceability issues necessary for stringent quality standards of CODEX.

Future prospects of meat industry

- Production of good quality animals for slaughter is must for production of good quality Hence, farmers’ cooperative can play a major role in the field of production and marketing of quality animals, extension education and encouragement of backward integration / contract farming as in poultry industry for intensive and semi-intensive system of rearing small ruminants.

- Food safety at all stages of production, processing, packing, storage and marketing of meat and meat products, maintenance of standards such as SPS, HACCP certification and others which are prescribed by the importing

- Consumer awareness: Priorities must be given to address the myths prevalent among the public regarding meat consumption and diseases (Meat consumption and risk of cancer, Meat consumption associated to increased risk of coronary heart disease due to its fat and cholesterol content) with proper extension programmes.

- Meat processing and value addition are key for the prosperity of meat Meat is packed only in some organized meat factories and in bacon factories. For safe delivery of the meat and various value added meat products through the various stages of processing, storage, transport, distribution and marketing packaging is of utmost importance.

- Breeding strategies: Meat scientists and animal geneticists should collaborates their research for developing a potential cross bred buffalo for meat Meat production potential under extensive and intensive system should be adequately exploited through cross breeding of selected local breeds / nondescript breeds with specific exotic and improved breeds.

- At present buffalo meat is obtained as a byproduct of buffalo milk production. There is vast scope for increasing Carabeef export consequent to cattle slaughter ban act, availability of male buffalo calves and the steady demand for the same from the importing Sufficient nutrition and improved levels of hygiene and sanitation at meat handling will enable India a quantum jump in meat production by utilizing the surplus male calves.

- Major portion of meat from sheep, goat, pig and poultry is primarily used for domestic consumption in the form of fresh Certain portion of meat from buffaloes, cattle and sheep is exported in frozen and chilled form. Meat production and supply of meat for local consumption is the most neglected sector in the country.

- Indian meat industry on scientific and mechanized lines is need for benefiting livestock producers, processors and finally Indian meat contains less fat and the present international trend is favourable for low fat meat. Average fat content of Indian meat (buffalo/poultry) is around 4% compared to 15-20% in most of the developed countries. Moreover, meat is free from growth promoters of other therapeutic residues and mad cow disease, which favours Indian meat in international trading.

References

APEDA. (2023). Export of agro and processed food products including meat and meat products. Agricultural and Processed Food Products Export Development Authority. Ministry of Commerce, Government of India.

DHADF, Department of Animal Husbandry, Dairying & Fisheries, Ministry of Agriculture, Government of India, New Delhi Annual Report, 2022-23.

Livestock Production Statistics of India 2022

(John, 2013).

(Truswell, 2002).

2oth Livestock Census dahd.nic.in

Basic Animal Husbandry Statistics, 2023

Truswell, A. (2002) ‘Cereal grains and coronary heart disease’, European Journal of Clinical Nutrition, 56(1), pp. 1–14. doi:10.1038/sj.ejcn.1601283.

https://www.insightsonindia.com/