Current Update of Demand And Supply In Indian Poultry Sector: An Overview

DR K. RAVI, SCIENTIST,CARI

According to Crisil Ratings, revenue of the Indian poultry industry has increased over 30% to Rs. 2,500 billion (US$ 31.4 billion) in FY 2022-23 so far, driven by higher realisation and steady volume.

Poultry capacity growth was limited during the last two fiscal years because of the pandemic. As a result, the growth in consumption of meat and eggs over 2021 was just 5% and 4% at 4.3 lakh tonne and 120 billion, respectively. Poultries have been operating at close to full capacity utilisation due to the demand remaining strong and an increase in population, higher per capita meat consumption, and increasing desire for diets high in protein.

Additionally, demand is outstripping supply in the hotels, restaurants, and cafes (HORECA) sector, which has caused the wholesale price of broiler chicken to increase. In FY 2022-23, the average price of broiler meat is expected to be between Rs. 135-140 (US$ 1.69-1.75) per kg.

However, due to a shortage of supplies, the price of maize and soymeal, two essential chicken feeds, has increased by approximately 35% and is unlikely to decrease this year. As a result, margins will decline for a second consecutive fiscal year.

Due to high demand and nearly full capacity utilisation, poultry production is expected to expand by 12% in FY 2022-23. Given that setting up and making these facilities completely operational takes just 3-6 months, these capacities are likely to start operating early next fiscal.

What is the status of India’s poultry sector?

- In six years ending 2020-21, the livestock sector registered a 8% CAGR.

- Specifically, in the poultry sector, egg production grew by 7.6% CAGR during the same period, taking production to over 120 billion.

- This fast growing poultry sector is projected to grow in the next five years at a CAGR of over 8 per cent to reach $35 billion.

- This growth will be driven by demographics, evolving food habits and rising urban incomes. With growth, the poultry industry is getting more and more organised.

- The Indian market is expected to mirror the developments in the world market where a gradual shift towards white meat is seen.

The Indian poultry Sector has over the years grown exponentially and playing a significant role in contributing to the India’s Gross value added among all the primary sectors.

The Indian poultry sector generates direct and indirect employment to more than 5 million rural and urban Indians, contributing to the 5% of Agriculture GDP. The production efficiencies in the poultry sector have improved significantly over last one decade.

The feed conversion ratio (FCR) in broiler meat production has come down to 1.55-1.6 against 1.8-1.9 a decade ago with an efficiency improvement of ~14%. Similarly, in the layer and breeder sector as well, the hen housed eggs and hen housed hatching eggs has improvised to a great extent. Today a layer bird during her economic life cycle is able to produce 330 edible eggs and a breeder bird lay about 180 egg is her economic lifecycle of 68-70 weeks. The greatness of Indian Poultry sector and its contribution to the nation is known to all within the sector and beyond with the growing traction, growth and developments in the sector.

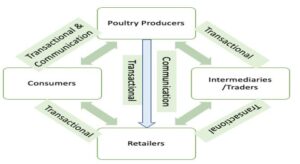

Fig: Traditional Value chain of a poultry Production Cycle:

The Perfect competition in Poultry:

In the recent years, the Indian poultry sector has advanced significantly towards brand building and value addition of chicken meat and eggs. However, the fact of the matter is, about 91% of chicken meat and eggs in the market is still being sold through wet market and open wholesale market as a commodity in a perfect competition scenario. Under such circumstances, the price becomes the only differentiations between the products. Therefore, the poultry farmers are most often compelled to fall into trap of competition from fellow producers and sell their produced at a under-price and incur losses in spite of the performance efficiencies.

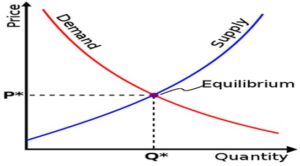

Fig: Fundamental Components of a perfect competition environment

Demand & Supply in Poultry sector:

In this article, an attempt has been made to discuss a few key aspects of demand and supply which applies to the all-range poultry products. Fundamentally, when the demand matches the supply, the price optimises, but in the sectors like poultry wherein the supply and demand data are not available in secondary sources, demand is predicted on the available produced based on a given price.

Fig: Traditional demand and supply Curve with optimal price point

The price above cost of production is a major indicator for demand in perfectly competitive market. If the poultry produce is sold in a price which is higher than the cost of production, the producers consider that to be the optimally available quantity. On the other hand, when the produced goods are sold in a price lesser than or closer to the cost of production, it is considered to be either a lower consumption demand or higher supply level with nominal demand. But the irony is, in the most of the cases, the actual consumption demand is measured through the price being offered by the intermediary buyers which may not be the right reflection of actual willingness to pay by consumers.

Price dynamics and volume of sales is the indicative of demand. A poultry farmer or a producer organisation identifies the demand based on the enquiry being made by customers over the previous period and price is obtained from that. Given the fact that measuring demand without knowing the actual pattern of consumption and supply is highly critical, the article aims at evaluating the fundamental facts which is to be looked at while deciding price of the poultry products.

Below are a few fundamental microeconomic concepts which are highly relevant with poultry sector in this regard.

Fig: Illustration of demand curve shifting leading to consumer surplus

Consumer Surplus:

It is an economic measurement of consumer benefits. A consumer surplus happens when the price that consumers pay for the poultry products is less than the price, they’re willing to pay. It’s a measure of the additional benefit that consumers receive because they’re paying less for something than what they were willing to pay. Lack of market information and desperate sales by the farmers mostly leads to a situation wherein the intermediary buyers gets the consumers benefit due the fact that the producers are not informed enough on the market prevailing price and available volume.

Producer Surplus:

On the other hand, a producer always tries to increase his producer surplus by trying to sell more and more at higher prices. However, it is simply not possible to increase the producer surplus indefinitely since at higher prices there might be very little or no demand for the produced goods. In a given circumstances, it is important for the producers to take an informed decision and identify the optimal production.

Both consumer surplus and the producer surplus occur in poultry sector in most of the time during the year due to the lack of information on supply and demand.

Deadweight Loss:

It is the excess burden created due to loss of benefit to the participants in the transaction which may be individuals as consumers or producers. In the supply chain of poultry produced, it is extremely important to maintain and streamline margins of intermediaries to eliminate the chances of deadweight loss for the consumers or producers.

Fig: Schematic representation of consumer and producer surplus and Deadweight loss

Opportunity Cost:

Opportunity costs represent the potential benefits that a poultry producer misses out on when choosing one alternative over another. Because opportunity costs are unseen by definition, they can easily be overlooked. Understanding the potential missed opportunities when a poultry farmer or a producer company chooses one options over another allows for better decision making.

Demand Measurement: Predictive Demand Vs Actual Demand

Sources: Statista 2022

The statistics depicts that the current population of India is at 1.39 billion or 1393.4 million. Out of the total population, 26.16 % of the Indian population fall into the 0–14-year category, 67.27% into the 15-64 age group and 6.57 % are over 65 years of age. According to the to the Indian National Family Health 2015–16 NFHS survey 75% of Indians are not vegetarian, the number is 78% for women and 70% for men. On the other hand, as per the poultry industry data, the per capita availability of chicken meat is ~ 5 Kg and edible egg is at ~65 numbers.

Segmentation of Consumers:

Table: Illustration of Indian population DemographyTable: Illustration of Availability of Chicken meat and eggs on target Population

Above table reflects that although the per capita availability of chicken meat and egg is at 5 kg and 65 eggs respectively, but actual availability on target group of consumers is at 10.28 kg and 128 eggs. Moreover 65% of the Indian population are reported to be from rural and purchase power parity is limited. The demand for meat and eggs drop drastically as soon as price goes up beyond a point leading to a surplus supply at the same production level.

Fig: Demand Measurement tools

Summary:

Price optimization in correlation with supply and demand measurement with the help of information and technology is the key for Indian poultry sector to ensure protect return on investment and benefit the most.

Fig: Schematic representation of desired relationship framework among the stake holders

The producer companies are required to consider at business models adding value towards vertical forward integration and reach out to the direct consumers so that the margins are maximised in the value chain which can be in turn passed on to the consumers to boost the consumption at a reasonable price. Establishing communication between the retailers and producers is the need of the hour to measure the actual demand at retail level based on which the dynamics of the price of different poultry products may be determined more efficiently.

What is the feed challenge?

- The rapidly growing poultry sector is forced to function under a legacy ecosystem that needs to be disrupted to ensure sustainable growth of the sector.

- Stakeholders in the feed market face several challenges, the most important of which is the uncertainty of feed availability, affordability and access.

- As feed constitutes a significant part of the overall production cost, higher feed prices impact production costs which in turn negatively impact demand because of the price sensitivity of consumers.

- In the last two years, the country’s poultry industry had to contend with unprecedented rise in the price of key feed material, maize and soymeal.

- The role of poultry comes into sharper focus when seen in the context of the country’s serious nutrition challenge.

- Poultry meat and eggs are loaded with protein that helps advance our nutrition security.

- So, this industry deserves support and protection primarily from unsteady availability of feed and undue price volatility in feed.

- To ensure adequate feed supply at economical rates, supplies have to be augmented which can be achieved by tweaking the trade policy.

What could the government do?

- Import of Soybean – India imports annually well over 3 million tonnes of soybean oil which is equivalent to about 20 million tonnes of soybean.

- As partial replacement for soyoil we can import the basic raw material soybean itself.

Soyoil is a semi-finished product intended for human consumption after refining.

- Import of soybean will deliver multiple economic benefits including utilisation of idle processing capacity in the solvent extraction even while augmenting oil availability for consumer and feed availability for poultry.

- There is no additional import but only partial replacement with raw material. It will lead to a win-win situation for stakeholders.

- The poultry industry must be allowed to import soybean or soymeal if need be under ‘actual user’ condition.

In 2021, the government took a bold and progressive decision to allow 1.2 million tonnes of soymeal import to help augment feed availability.

- Import of DDG – Dried Distillers Grain (DDG) is the residue grain that remains after extraction of ethanol from corn/maize.

- Import of DDG should be allowed too. This key feed material will help the poultry industry and insulate it from undue price volatility in maize.

- The poultry industry needs a liberal foreign trade policy to access feed material. so, it is necessary for the government to act. At the same time, the industry must act too.

What could the industry do?

- Industry must plan for assured and captive availability of soy and corn which can ensured by establishing backward linkages.

- Contract farming, especially partnering with the Farmer Producer Organisations (FPOs) will help achieve scale economies.

- The industry must recognize that commodity price volatility cannot be wished away; but it can be managed.

- So, the industry players must manage their price risk by using the exchange-traded derivative contracts which is a time-tested and scientific way to protect built-in profit margins.

- ‘Delivery based forward contracts’ can also be considered.

- The poultry industry must also build commercial intelligence and research capability to track the feed market dynamics and drivers, both domestic and global.

A strong government-industry-research interface is called for to bring global best practices to India to ensure food safety, food hygiene and not the least, animal care.

- Indian poultry sector will continue to grow; but its growth trajectory can be strengthened and elevated with clear road map and strategies to achieve higher levels of overall growth, demand and turnover.

- The industry leaders have to be clear about where they want the industry to be by say 2030.

- For this, demand projection is necessary in terms of the number of layers/ broilers needed, feed requirements, vaccines for bird health, processing capacity, investment and skillsets.

- To realise its growth potential, this industry deserves policy, investment and research support.

- In setting a roadmap, sustainable growth by adopting sustainability principles must become the watchword.

Reference-: Dr. Anjan Goswami