Indian Animal Health Industry: Present & Future

The Indian Animal Health Industry has played a vital role in safeguarding the animal husbandry interests of the nation. The Indian animal healthcare market is estimated to be around Rs. 7000 crores (2021-22). The species share in AH market is 55% of livestock, 33% of poultry, 8% of companion animals, 3% of Aqua and rest 1% for other remaining animals. Though there are no published data, INFAH anticipates the contribution of various categories of animal health products as 39% Nutritionals, 20% paraciticides, 17% antibacterials, 13% biologicals, and 11% from other categories. There are nearly >50 major companies operating in Animal health market in India though the market is dominated by top 10 players.

The regulation of Animal health products in India is under the control of Veterinary Cell of CDSCO (Central Drug Standard Control Organisation). The technical review for veterinary products for registration is done by Department of Animal Husbandry and Dairying for the farm and companion animal products and Department of Fisheries for the Aqua products. The Biologicals are studied and evaluated by Indian Institute of Veterinary Science (IVRI). Department of AYUSH is responsible for bringing regulations for herbal and contemporary medicines meant for animal use.

Animal Husbandry in India has undergone magnificent changes over the years, thanks to the adoption of innovative technologies used for prevention and cure of farm and companion animals. There has been a paradigm shift in the business approach of Animal health companies that have evolved from therapeutics to preventive to productivity enhancement and now to overall healthcare of the animals.

Through new approaches and paradigm, the animal health industry has evolved and propelled the animal husbandry to new heights of glory. India’s surge to the top of milk and egg production reinforces the significance of Animal Health Industry. The Animal health industry is working together and strengthening the Animal Husbandry in the country.

The animal health industry in India has transformed itself in recent years from disease control and treatment activities to a complete healthcare provider and supporting the task of bridging the protein gap. It is expected to grow at an annual rate of 10 to 11 per cent as against 2 to 3 per cent global growth. India is one of the fastest growing animal health markets globally. In an effort to provide quality and safe products, the Indian animal health industry has taken several important initiatives.

Keeping pace with the consistently increasing contribution of the livestock sector to agricultural GDP, the Indian animal health industry has made impressive strides to meet growing needs of this segment. Often seen as an offshoot of the human pharmaceutical business, India’s animal health industry, estimated at Rs 42,000 million (US $650 million), is all set to play its role to enhance overall animal productivity and ensure safe food for the end consumers.

In the early ‘fifties, the animal health industry made a beginning when multinational pharmaceutical organisations started their specialised animal health divisions. Some Indian companies too realised the need of separate focused veterinary divisions. Post WTO and GATT, the world has witnessed tremendous impact of increased focus on research and consolidation of the animal health businesses through mergers and acquisitions. As a consequence of expiry of patent of blockbuster molecule/drug and also increasing

emphasis on affordable treatment, a huge generic opportunity has emerged in Africa and Asia as well as to a significant extent in Europe and America.

Figure 1. Product wise segmentation of global animal health market in 2014.

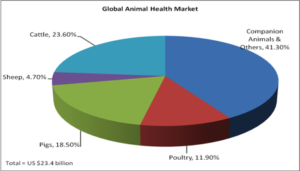

Figure 2. Species wise segmentation of global animal health market in 2014.

Source: Vetnosis Outlook 2014.

Figure 3. Evolution of the global animal health market, 2004–2014.

*Nominal Dollars: Value without adjusting inflation (billion dollars)

Source: Vetnosis Outlook 2014

Figure 4. Regionwise percentage growth of global animal health market, 2013.

*Real Value: Inflation adjusted

Source: Vetnosis Outlook 2014

Market Overview

The Indian veterinary healthcare market was valued at approximately USD 1,169.8 million in 2021, and it is expected to reach USD 1,856.3 million by 2027, registering a CAGR of more than 7.70% during the forecast period, 2022-2027

The COVID-19 pandemic has been continuing to transform the growth of various markets, as the immediate impact of the outbreak is varied. While a few industries registered a drop in demand, numerous other markets may continue to remain unscathed and show promising growth opportunities. In addition, supply disruption and medicine shortages of veterinary medicines had been observed in several countries, primarily due to the temporary lockdowns of manufacturing sites, export bans, and increased demand for medicine, for the treatment of COVID-19. Hence, the market is anticipated to be impacted during the pandemic due to the reduced veterinary visits, along with the shortage of veterinary medicines, during the outbreak of COVID-19

Zoonotic diseases are naturally transmitted from animals to humans due to the consumption of contaminated food and water and exposure to the pathogen during preparation, processing, or by direct contact with infected animals or humans. Zoonotic diseases are caused by microorganisms, like viruses, bacteria, parasites, and fungi. Microbes can cause different types of diseases in humans and animals, ranging from mild to serious infections, and can even lead to death. As per the article published by the Indian Journal of Community Infection 2020, by Sanjiv Kumar, in India, 13 zoonoses are the cause of 2.4 billion cases of human disease and 2.2 million deaths per year. Among the developing countries, India has the highest zoonotic disease burden, with widespread illness and death. Hence, owing to these factors, the market is expected to grow in the forecast period.

The market is largely driven by the approval of new products related to the treatment of animal disorders. In September 2019, the Prime Minister of India inaugurated a livestock vaccination scheme with INR 13,343 crore aimed at controlling livestock diseases, especially foot and mouth disease (FMD) and brucellosis. In addition, in March 2020, Wiggles, an Indian pet care startup, launched online veterinary consultation for pets across India. In January 2019, under the ‘Animal Health and Welfare Policy 2018, the Delhi government launched its first 24×7 veterinary hospital to provide extended care to companion and farm animals, which will likely boost the market.

The increasing importance of the production of livestock animals is generating growth in the veterinary healthcare market. The Indian veterinary healthcare market is segmented by product (therapeutics (vaccines, parasiticides, anti-infectives, medical feed additives, and other therapeutics), diagnostics (immunodiagnostic tests, molecular diagnostics, diagnostic imaging, clinical chemistry, and other diagnostics), and animal type (dogs and cats, horses, ruminants, swine, poultry, and other animals). The market report also covers the estimated market sizes and trends for 17 different countries across major regions globally. The report offers the value (in USD million) for the above segments.

| By Product | |||||||||||||||

|

|||||||||||||||

|

|||||||||||||||

| By Animal Type | |||

| Dogs and Cats | |||

| Horses | |||

| Ruminants | |||

| Swine | |||

| Poultry | |||

| Other Animals | |||

Key Market Trends

The Vaccine Segment is Expected to Have the Highest Growth Rate Over the Forecast Period

India has been in lockdown and has suspended trade with other countries and implemented travel restrictions, which affected the import and export activities of veterinary medicines and diagnostics, leading to a decline in sales of many products. Supply disruption and medicine shortages of veterinary medicines have been observed in several regions due to the temporary lockdowns of manufacturing sites, export bans, increased demands for medicine for the treatment of COVID-19, and the stockpiling of medicines by individuals. However, the government has been taking up measures to mitigate the supply of medicines and veterinary practices during the COVID-19 pandemic. For instance, in March 2020, the Government of India stated that all states must ensure that medical help for animals is treated as an essential service, which does not get suspended during COVID-19 lockdowns across the country.

Vaccines are comprised of viruses, bacteria, or other disease-causing organisms that have been killed or altered so that they cannot cause any disease, thus, boosting immunity. Vaccines are being manufactured that contain genetically engineered components derived from those disease agents. The vaccines segment is expected to be driven by innovations in vaccines, growing awareness of animal health, increasing investments by government bodies and associations, increasing demand for animal protein, including milk, meat, eggs, and fish, and rising healthcare expenditure for companion animals.

In May 2021, Hyderabad-based Indian Immunologicals Limited (IIL) launched Raksha Class, a classical swine fever (CSF) vaccine, which is a unique cell culture technology-based vaccine for pigs, developed in collaboration with the Indian Veterinary Research Institute (IVRI), Bareilly.

Competitive Landscape

The Indian veterinary healthcare market is moderately competitive and consists of several major players, such as Boehringer Ingelheim GmbH, Elanco Animal Health, IDEXX Laboratories Inc., Merck & Co. Inc., Vetoquinol SA, Virbac, and Zoetis Inc. These companies are primarily focusing on various growth strategies, such as collaborations, partnerships, agreements, mergers, and acquisitions, in order to enhance their market presence.

Major Players

Recent Developments

- In May 2021, Boehringer Ingelheim India launched its poultry vaccine VAXXITEK HVT+IBD, an innovative recombinant single-shot vaccine for ensuring the life-long protection for all types of production chickens, namely, broiler, layer, and breeder.

- In December 2021, Fujifilm India Pvt. Ltd, a pioneer in medical imaging and diagnostic technologies, recently joined hands with A’alda Vet India Pvt. Ltd to boost healthcare facilities for pets. As part of the partnership, Fujifilm India will provide innovative medical and screening devices to DCC (Dogs, Cats, and Companions) animals.

India Animal Healthcare Market Outlook 2031

- The animal healthcare market in India was valued at US$ 869.54 Mn in 2021

- The market in the country is projected to expand at a CAGR of 6.9% from 2022 to 2031

- The animal healthcare market in India is anticipated to exceed US$ 1.36 Bn by the end of 2031

Analysts’ Viewpoint on India Animal Healthcare Market Scenario

Companies in the animal healthcare market in India are focusing on diseases, such as zoonotic diseases, and their treatments to keep their businesses running post the COVID-19 pandemic. The market in India is expected to expand at a CAGR of 6.9% during the forecast period due to several factors. For instance, the number of household companion animals is increasing in India. Therefore, companies strive to increase R&D and innovation toward disease and treatment products for pet animals, which is likely to propel the animal healthcare market in India. Similarly, livestock or domesticated animals, which are generally used for the production of meat, milk, fibers, etc., are increasing, owing to rise in demand for respective products in the country. Surge in impact of animal diseases and rise in awareness about the same are likely to fuel the growth of the animal healthcare market in India.

Increase in Incidence of Zoonotic Diseases Drives India Animal Healthcare Market

The rapid spread of zoonotic diseases in India is a major challenge for healthcare practitioners. Factors responsible for rise in prevalence of zoonotic diseases are demographic changes, encroachment of land, and agricultural practices. Zoonotic diseases such as bovine encephalopathy & foodborne, vector borne, and waterborne zoonotic diseases affecting the growth of animals in India. Hence, preventive measures are being taken into consideration by the government to control these diseases affecting human population.

Continuous efforts to spread awareness about zoonotic diseases and their prevention by market stakeholders are responsible for animal healthcare market development in India. Rise in awareness about precautionary measures and availability of several treatment options are likely to drive the demand for animal healthcare services in the upcoming years.

Rise in Number of Online Veterinary Pharmacies in India

There is a rapid of expansion of retail and hospital pharmacies providing veterinary drugs, nutritional supplements, pet vaccines, etc. for effective treatment of various diseases and injuries in animals in India. Increasing number of eCommerce channels and online pharmacies in India is a largest opportunity for animal healthcare market players in India. There is a huge demand for animal medicines and other healthcare products for animals from online pharmacies due to their discounted prices, availability of products, and ease of transaction. Pet owners are taking care of their pets by buying routine vaccines, disease preventive medicines, and pharmaceutical drugs form online channels.

Increase in Government Support to Boost India Animal Healthcare Market

Market stakeholders are expected to witness tremendous growth opportunities in animal healthcare market due to rising investment by the Indian government to improve animal healthcare services. Stringent laws and regulations by the Indian government to promote awareness about animal health are driving the market in the country. Due to rising zoonotic and foodborne diseases in animals, government is investing in R&D activities to develop efficient vaccines. Several veterinary research laboratories are receiving financial grants from the government to help control the spread of diseases in animals.

Moreover, vaccination facilities, veterinary healthcare services, and better treatment facilities are provided to better the health of animals in India. Many animal activists are fighting for animal rights, animal abuse, and illegal slaughtering of animals. Rising number of animal lovers, along with increasing government activities to promote animal health products are some of the ongoing trends in the animal healthcare market in India.

Need to Improve Health of Animals Drive Adoption of Telemedicine Tools

Increasing efforts by the government of India to spread awareness about telemedicine tools in the animal healthcare sector is creating value-grab opportunities for market players. Pet owners have adopted telemedicine practices and remote consultations with the help of digital products to keep an eye on the health of their beloved pets. Zoonotic and food-borne diseases, among others, which are prevalent on a large scale in India is expected to generate food security challenge in the country. Hence, various companies in the animal healthcare market are heavily investing in research & development activities to produce advanced vaccines, pharmaceutical drugs, pharmaceutical pet supplies, medical devices, etc. This factor is contributing to the development of companion animal healthcare market in India. All these factors have boosted the veterinary healthcare services as well in India.

Limited Access to Animal Healthcare Services Key Challenge for Market Growth in India

Companies in the animal healthcare market in India have managed to maintain fast revenue growth in spite of the massive disruptions caused by the COVID-19 pandemic. However, high costs and lack of access to animal healthcare services in India are expected to hinder market growth in the upcoming years. Limited availability of veterinary clinics in India is expected to hamper the growth for animal healthcare market in India. Market stakeholders and the Indian government are taking initiatives to launch innovative and cost-effective products to help veterinarians. Low access to animal healthcare services and lack of knowledge and awareness about animal health in some states of India, and rise in burden of various infectious diseases in animals are directly affecting market growth.

India Animal Healthcare Market: Overview

- The animal health industry in India has played a vital role in safeguarding the animal husbandry interests. The technical review for veterinary products for registration in the country is carried out by the Department of Animal Husbandry and Dairying for the farm and companion animal products and the Department of Fisheries for the aqua products.

- Animal healthcare in India has undergone significant changes in the past few years due to the adoption of innovative technologies for prevention and cure of diseases in farm and companion animals

- Zoonotic diseases are naturally transmitted from animals to humans due to the consumption of contaminated food & water and exposure to the pathogen during preparation, processing, or by direct contact with infected animals or humans.

- Rise in prevalence of zoonotic diseases and growth of the veterinary pharmaceutical industry are the major factors driving the animal health market in India

- Increase in integration of IoT with animal health monitoring solutions and surge in usage of mobile sensors and wearables to monitor animal behavior and health propel the animal health market in the country

- Regulation of animal health products in India is under the control of the Veterinary Cell of CDSCO (Central Drug Standard Control Organization).

- The biologicals and products related to veterinary healthcare are studied and evaluated by the Indian Institute of Veterinary Science (IVRI). The Department of AYUSH is responsible for bringing regulations for herbal and contemporary medicines meant for animal use.

- Animal husbandry in India has undergone significant changes over the years due to the adoption of innovative technologies used for prevention and cure of farm and companion animals

- There has been a paradigm shift in the business approach of animal health companies that have evolved from therapeutics to preventive to productivity enhancement and now to overall animal healthcare

- Through new approaches, the animal health services and related industry has evolved and propelled the livestock and companion animal husbandry market. India’s surge to the top of milk and egg production reinforces the significance of the animal health industry. The animal health industry is working together and strengthening animal husbandry in the country.

Rise in Prevalence of Zoonotic Diseases Drives India Animal Healthcare Market

- Incidence rate and prevalence of zoonotic diseases have increased in India. This is most likely due to demographic changes, encroachment of land, and agricultural practices.

- Zoonotic diseases such as bovine encephalopathy and foodborne, vector borne, and waterborne zoonotic diseases affect socio-economic status

- Despite efforts in screening, prevention, and control, and the gathering and sharing of information learned through outbreak investigations and disease surveillance, zoonotic diseases have found a way to continue to affect the human population. However, there have been successful campaigns to limit the spread of zoonotic diseases and there is continuous effort to protect, educate, and aid the population in the fight against these diseases.

Significant Growth of Veterinary Pharmaceutical Industry to Propel India Animal Healthcare Market

- Professionals of veterinary healthcare use veterinary drugs to treat diseases, injuries, and help the growth of animals. These are primarily used to cure diseases and prevent the spread of infectious diseases among animals. These drugs indirectly benefit human healthcare by restricting the spread of infectious diseases from animals to humans.

- Pet ownership and awareness about diseases related to animals has shown positive impact on Animal Healthcare Market. People are forming strong emotional bonds with their pets, which results in a willingness to spend on care that maintains or improves their health, including veterinary healthcare and pharmaceuticals.

Bovine Segment Held Significant Share of India Animal Healthcare MarketCattle are by far the most numerous type of livestock in India. The country is the leading milk-producer in the world, where dairying is considered a major source of livelihood for farmers.

- There has been a major thrust by the government to boost milk production by supporting programs for increasing milk productivity, input suppliers, and access to organized milk processing sector

Rise in Integration of IoT with Animal Health Monitoring Solutions Propels Market

- Wireless methods include the use of Internet of Things (IoT), which is a growing intent-based information that allows trade and aims to provide a manner in which information related to animal health can be exchanged in a convenient and secure way

- IoT is used for animal health care monitoring, which is important in order to reduce the risk of infection among animals. Animal health monitoring and proper animal husbandry can be conducted with this technology.

- Usage of biosensors and wearable technologies is becoming increasingly important for animal health management. These devices can provide timely diagnosis of diseases in animals, eventually decreasing economic losses.

Zonal Outlook of India Animal Healthcare Market

- South Zone accounted for the largest share of 33.19% of the animal healthcare market in India in 2021. The market in the South Zone is projected to expand at a CAGR of 6.5% from 2022 to 2031.

- West Zone held the second largest share of 24.48% of the market in the country in 2021. The animal health market in West Zone is anticipated to expand at a CAGR of 7.1% during the forecast period.

Major Players Analysis

- The animal healthcare market in India is consolidated, with a small number of key players accounting for majority of the market share. Most companies are making significant investments in comprehensive research and development.

- Expansion of product portfolios and mergers & acquisitions are the key strategies adopted by the key players. The animal healthcare market in India is consolidated due to presence of large number of players. Key players operating in the market in India include

- Pfizer plc

- Sanofi SA

- Novartis AG

- Olympus Corporation

- GlaxoSmithKline plc

- Zydus Lifesciences Ltd.

- Merck & Co., Inc.

- Sun Pharmaceutical Industries Ltd.

- Lupin Ltd.

- Each of these players has been profiled in the animal healthcare market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments

India Animal Healthcare Market Snapshot

| Attribute | Detail |

| Market Size Value in 2021 | US$ 869.54 Mn |

| Market Forecast Value in 2031 | US$ 1.36 Bn |

| Growth Rate (CAGR) | 6.9% (Year-to-Year) |

| Forecast Period | 2022–2031 |

| Historical Data Available for | 2017–2020 |

| Quantitative Units | US$ Bn and Mn for Value |

| Market Analysis | It includes cross segment analysis as well as at regional level. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Zones Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

India Animal Healthcare Market – Segmentation

TMR’s study on the animal healthcare market includes information divided into four segments: animal type, therapeutic type, distribution channel, and zone. Changing industry trends and other crucial market dynamics associated with these segments of the animal healthcare market are discussed in detail.

| Animal Type |

|

| Therapeutic Type |

|

| Distribution Channel |

|

| Zone |

|

INDIAN ANIMAL HEALTH INDUSTRY OUTLOOK

The Indian animal health sector continues to contribute to the growth and development of Indian livestock industry by way of providing superior health solutions for prevention and control of diseases as well as increasing farm productivity. The animal health industry has transformed itself in recent years from disease control and treatment activities to a complete healthcare provider and supporting the task of bridging the protein gap of India.

The industry has grown from an annual size of Rs 90 million (US $1.5 million) in 1970 to over Rs 42,000 million (US $650 million) in 2014. The Indian animal health industry is growing at an annual rate of

8 to 10 per cent as against 2 to 3 per cent growth of global animal health industry. The CAGR of 11 per cent between 2008 and 2014 makes India as one of the fastest growing animal health markets globally.

The business is driven by two major segments—dairy and poultry—apart from significant growth potential in aqua, pets and small ruminants market segments in the future. The last decade has seen the entry of many new Indian and multinational companies. These companies market wide range of animal health products such as nutritional and non-nutritional supplements like vitamins, minerals, enzymes, antioxidants, pre & probiotics, etc. This is in addition to therapeutics and different kinds of farm hygiene products such as disinfectants, anti-toxin products, etc, and biological products to prevent various existing and emerging diseases. All of them improve farm productivity and animal health and disease prevention. Although almost 50 per cent of this market is contributed by the top 10 to 15 multinational and Indian companies who have established research, marketing and distribution strengths, the regional players comprising small and medium size generic companies have shown aggressive growth trends and entrepreneurship.

Animal health industry has a vital role to play in realisation of animal food objectives:

- Prevention and control of emerging and re-emerging diseases of economic importance

- Improving health and productivity.

- Ensuring safe, healthy and nutritious animal protein to meet the growing demand of Indian population.

- Providing newer and cost effective solutions in diagnosis and disease management.

- Quick dissemination of relevant technical information at the doorstep of all stakeholders.

Animal Health Industry Estimates

Animal health products market in India will grow at a CAGR of 10-11 per cent to reach about 60,000 million by 2018. The dairy segment would outperform poultry and companion animal segments.

Figure 5. Indian animal health industry market size and expected growth, 2014-2018.

As per animal health industry estimates, the share of aqua segment is approximately 3% which is included above in “others”

The factors contributing to the growth of animal health market are:

- The Operation Flood project ensured modernisation of the Indian dairy sector with cooperative networks ensuring small farmers better prices.

- Increasing consumption of animal protein based products.

- Increasing integration especially in poultry and large dairy farms.

- Improved awareness on right management practices.

- Sourcing hub of herbal medicaments across the world.

- Veterinary services is improving in its reach to customers and getting more specialised

- Highly contagious diseases like Foot & Mouth Disease (FMD), Brucellosis and PPR have been major limiting factors of Indian dairy products in export markets. The Government of India has undertaken major initiatives to eradicate these diseases.

- The National Dairy Plan launched by the National Dairy Development Board (NDDB) with the objective of increasing productivity and creating infrastructure for handling milk is ensuring growth of the Indian dairy sector.

On the other hand, the limiting factors are:

- Lack of spending in marketing is leading to too many stakeholders between producers and consumers.

- Low milk productivity per animal.

- Huge population of unproductive animals put pressure on feed/fodder availability.

- Lack of government initiatives for promoting value addition in milk through private sector.

- Less focus on value addition in finished products.

- Mastitis — still a major challenge.

- Inadequate cold storage facilities.

- Lack of adequate quality grading standards.

- Biosecurity threat.

- Lack of zoning.

- Increasing cost of feed, labour, transportation, unpredictable monsoon etc.

- Limited share of milk processed by the organised dairy sector.

- Lack of reliable published data.

- Fragmented industry.

- Low investments in R & D and less dissemination of knowledge from lab to land.

- Emerging and re-emerging diseases.

INITIATIVES BY INDIAN AH INDUSTRY

In an effort to provide quality and safe products, the Indian animal health industry has taken several important initiatives. These initiatives also enable the industry to appropriately respond to emerging health and production needs of the dairy industry. Some of the important initiatives are:

- Anticipate and comply with regulatory situation in India and globally to ensure greater quality and safety of animal health products. This includes initiatives like mentioning the withdrawal period on the packaging, guiding the user for judicious use of antibiotics and promoting the best practices for the use of feed supplement products.

- Promote international collaboration to bring and share latest technical know how and products suitable for the cattle and buffalo population in India. This initiative is in the field of new diagnostics/products for good management of animal health issues and also various devises to help increase productivity of animals.

- Promote local research through joint collaboration with other research institutions to generate database of animal diseases so that appropriate measures can be initiated for controlling/managing the related health issues. It also involves generating more data on product efficacy and safety that helps to our farmers/vet to use these products confidently.

- Promote awareness by sharing vital information linked to issues/challenges in animal health and production. This help to adopt good management practices by farmers and improves compliances.

Registration of new products and regulatory submission guidelines

The apex body of the drugs regulatory system, Central Drug Standards & Control Organization (CDSCO) has taken several initiatives to ensure that the Indian pharmaceutical as well as animal health industry meets the WHO, GMP standards and ensure global regulatory requirements. This process has lead to emergence of many newer guidelines for the industry. The adoption of Drug Master File (DMF) and product dossier concept, data according to specific formats are now mandatory. This will enable our industry to be more competitive and regulatory savvy.

New import regulations

Recently the importers of veterinary biologicals were asked by the authorities to provide molecular characterisation of vaccine strains and its phylogenic relationship with the prevailing disease in India. However not too many studies have been undertaken by our research institutions in canine and poultry segments.

Advisory circulars issued by authorities from time to time

Various circulars, guidelines, and notifications received by animal health industry have compelled us to evaluate its impact on business. Issues like FDCs or Schedule H1, use of antibiotics in animal feeding have given us a resolve to come up to the regulator’s expectations.

Challenges affecting veterinary herbal formulations

The herbs are part of medicine since centuries. With the evolution of medicines, the herbal products have created a niche in the treatment and prevention of disease in human and animals. The age-old herbal industry is not without concerns or hurdles which is preventing its natural growth. However, the herbal formulation manufacturers face issues like:

- No specific guidelines for categorisation of herbal products whether into therapeutics or feed supplements. Also for licensing of herbal extracts and herbal feed supplements, there are no specific guidelines for approval, allowed usage of only BIS/IP excipients.

- Raw material availability.

- Creation of a specific herbal pharmacopeia with detailed technical monographs.

- Ascertaining microbial limits of herbal products.

- Introduction of herbal medicines in veterinary curriculum.

Animal health industry specific requirements

Animal health’s requirements are very different from those of human health care. This is because animal health deals with food producing animals apart from pets and companion animals. Also, the animal physiology differs from that of human physiology in terms of its requirement for growth, maintenance and productivity. However, since there are no separate regulations for veterinary drugs in India, veterinary drugs and regulatory processes are benchmarked with human pharmaceutical products.

Attracting manpower

Manpower is the essential component of any industry and our animal health Industry is no exception. With the passage of time, the business processes might have changed, however our industry faces huge shortage of manpower required to serve the above segments. We have seen the preference of new generation towards more glamorous industries whereas our industry essentially remains at the grass root level connected to rural and semi-urban areas. Attracting and retaining the quality talent pool is and will always be a challenge.

With the growing contribution of animal health segment in India’s GDP, there has been an emergence of several private dairy and poultry enterprises in addition to existing network of cooperatives. This is beside the huge demand for canine specialists in the expanding urban market and increasing contribution from aqua sector to India’s food basket.

The curriculum of veterinary science education programmes needs a fresh review since they have to be revised and made relevant to the current and future requirements of the animal health industry. The institutions should take responsibility of building a talent pipeline specifically for poultry/dairy/canine/equine sectors. The industry needs to focus on quality talent pool and align compensation to keep the sector attractive enough. The animal health industry should also focus on upgrading the skill sets of their human resource to enhance their productivity.

COLLABORATIVE INITIATIVES: POOLING RESOURCES

One of the major limitations of the animal health industry is R&D. The relatively smaller size of the industry and lesser price attractiveness has resulted in this situation. However, with the growing regulatory requirements and to tap global markets, there is a need to relook at this scenario. The future thrust areas can be as follows:

- Sero-typing of disease causing agents for accurate diagnosis and subsequently bringing out the effective prevention and remedial measures.

- Assignment of contract research projects related to new challenges being faced by poultry and dairy industry.

- Collaborative research and development for bringing novel and improved animal healthcare products.

- Ensuring food security through safe and nutritious animal protein to all.

The formation of National Institute of Animal Biotechnology (NIAB), an autonomous research institution of the Department of Biotechnology, Ministry of Science & Technology, Government of India, to harness novel and emerging biotechnologies and take up research in the cutting edge areas for improving animal health and productivity under Public-Private-Partnership (PPP) model is a step in the right direction. Such models have been proved as ideal way of making R&D with country specific priorities. The model makes optimum usage of best possible talent pool and public as well as private sector infrastructures to meet mutual objectives in most effective manner.

EXPECTED TRENDS

- The existing growth rate of the livestock sector is expected to continue in future (Table 1).

- Biological segment will contribute to the industry growth with the maximum growth rate of around 12 to 14 per cent. Industry believes that this growth will be due to the shift from “disease treatment” to “prevention and nutrition” to enhance the productivity.

Table 1: Growth rate of animal health industry segments.

| Segment | Growth rate

(percentage) |

Remarks |

| Dairy | 11 to 13 | Transformation into an efficient industry |

| Broiler | 8 | Consolidation, rural marketing and exports |

| Layer | 10 | Expansion in to big farms, export focus on egg and egg-based products |

| Animal Health | 10 to 12 | Industry strongly believes that there will not be de-growth in near future |

| Canine (Pets) | 17 to 18 | Fast growing segment due to urbanisation and nuclear families |

- Innovative novel technological products will be introduced especially in the nutrition and biological sector for better productivity and to prevent the existing and emerging diseases.

- Export potential envisaged in African Markets (around `20,000 to 25,000 million) and Middle-East and North Africa (MENA) markets.

- Since Indian animal health care industry predicts substantial growth in near future, international players are expected to step in.

- Industry is cautious on cost and hence cost leadership is essential to garner higher market share.

- In dairy, nutritional products will grow and fibre digesting supplement products will emerge as one of the growth contributors of this segment.

- Industry is expecting the upcoming of corporate dairies with around 500 to 1000 animals.

- Modern dairy farms with full automation and mechanisation will happen and big dairies and adopted mechanisation programmes will be noticed for small dairy farmers.

- The future growth in dairy segment drastically depends on the government intervention like restrictions on loose milk sales, vaccine regulations, etc.

- We can anticipate growth in segments of small ruminants like goat and sheep. Deep litter goat farms are emerging and will grow into a big industry.

- Globally middle class population and their per capita income are increasing and hence the demand for animal protein based products will grow.

- Intense competition is expected in the feed supplements category due to low entry barrier and local players and fly by night operators who do not care for quality.

The focus of Indian pharmaceutical regulatory bodies is now shifting towards risk management and science based GMP regulations together with ensuring the affordability of quality medicines. The need of the hour is to make our animal health industry compliant with regulatory requirements and to convert industry research to a safe and innovation driven product.

Changes and challenges are difficult and tough initially but facing them with determination yields a long lasting success. The animal health industry in India is all set to play its role in protecting the animal wealth of India, play an active role in food security by providing quality protein for the growing population as well as ensure food safety to the public in particular and environment in general.

“Healthy Animals, Healthier India and the World!”

Source-SATISH PASRIJA

Former Managing Director, Virbac Animal Health India Pvt Ltd