MARKETING STRATEGIES OF DAIRY MILK & MILK PRODUCTS & USE OF E-MARKETING IN INDIAN DAIRY SECTOR

Globalization is one of the greatest strategic challenges for all Industries as well as dairy Industry. Globalization has increased significantly over the last decade, and despite financial crises and recession in many parts of the world globalization will likely continue — albeit with less force than before. Globalization is far from a unique concept. Globalization can also have multiple dimensions and applications. In this context, globalization is defined as follows: Globalization is the continuing development of a firm’s international involvement concerning geographical markets, products, management, resources (labour, raw materials etc.) for the purpose of optimization of the international market opportunities and threats. Globalization is not just about selling to foreign customers. It is also about recognizing the international competition and to adjust production, resources, investment and organization to these challenges.

Dairy marketing truly came into the public’s consciousness with the introduction of the “Got Milk” campaign in 1993. The basic dairy product became associated with a memorable and catchy slogan that helped drive sales. There are many other strategies, though, to market all types of dairy products. These include promotion of nutritional value, appeal to the organic market, and use of social media networks and development of new dairy products. According to American Marketing Association marketing as “the process of planning and executing the conception, pricing, promotion, and distribution of ideas, goods, and services to create exchanges that satisfy individual and organizational objectives.” Marketers use an assortment of strategies to guide how, when, and where product information is presented to consumers. Their goal is to convince consumers to buy a particular brand or product. Successful marketing strategies create a desire for a product. A marketer, therefore, needs to understand consumer likes and dislikes. In addition, marketers must know what information will convince consumers to buy their product, and whom consumers perceive as a credible source of information. Some marketing strategies use fictional characters, celebrities, or experts (such as doctors) to sell products, while other strategies use specific statements or “health claims” that state the benefits of using a particular product or eating a particular food. Impact and Influence Marketing strategies directly impact food purchasing and eating habits. For example, in the late 1970s scientists announced a possible link between eating a high-fiber diet and a reduced risk of cancer. However, consumers did not immediately increase their consumption of high-fiber cereals. But in 1984 advertisements claiming a relationship between high-fiber diets and protection against cancer appeared, and by 1987 approximately 2 million households had begun eating high-fiber cereal. Since then, other health claims, supported by scientific studies, have influenced consumers to decrease consumption of foods high in saturated fat and to increase consumption of fruits, vegetables, skim milk, poultry, and fish. Of course, not all marketing campaigns are based on scientific studies, and not all health claims are truthful. In July 2000 a panel of experts from the U.S. Department of Agriculture supported complaints made by the Physicians Committee for Responsible Medicine that the “Got Milk” advertisements contained untruthful health claims that suggested that milk consumption improved sports performance, since these claims lacked scientific studies. Companies often use celebrity’s characters to appeal to young consumers and common consumers. Currently, about one-fourth of all television commercials are related to food, and approximately one-half of these are selling snacks and other foods low in nutritional value. Many of the commercials aimed at children and adolescents use catchy music, jingles, humor, and well-known characters to promote products. The impact of these strategies is illustrated by several researcher studies showing that when a majority of television commercials that children view are for high-sugar foods, they are more likely to choose unhealthful foods over nutritious alternatives, and vice versa. Inappropriate Advertisements Attempts to sell large quantities of products sometimes cause advertisers to make claims that are not entirely factual. For instance, an advertisement for a particular brand of bread claimed the bread had fewer calories per slice than its competitors. What the advertisement did not say was that the bread was sliced much thinner than other brands. Deceptive advertising has also been employed to persuade women to change their infant feeding practices. Advertisers commonly urge mothers to use infant formula to supplement breast milk. Marketing strategies include one strategy used by advertisers is to feature a celebrity in their advertisements or on their packaging. The implicit message is that the celebrity endorses the product, uses the product, and may even depend on the product for success. Many groups have objected to the use of marketing strategies that include free formula and coupons, and infant-formula manufacturing companies have been forced to modify their marketing practices. Other marketing strategies involve labeling foods as “light,” meaning that one serving contains about 50 percent less fat than the original version (or one-third fewer calories). For example, a serving of light ice cream contains fifty percent less fat than a serving of regular ice cream. As a result, consumers mistakenly believe that eating light food means eating healthful food. However, they fail to realize that a serving of the light version of a food such as ice cream can still contain more fat and sugar than is desirable. Food labels with conflicting information often confront consumers. For example, labels claiming “no fat” do not necessarily mean zero grams of fat. Food labeling standards define low-fat foods as those containing less than 0.5 gram of fat per serving. Therefore, consuming several servings may mean consuming one or two grams of fat, and people are often unaware of what amount of a food constitutes a “serving.” In addition, foods low in fat may be high in sugar, adding additional calories to one’s daily caloric intake. Too often, consumers mistakenly translate a claim of “no fat” into one of “no calories.” It is also important for consumers to recognize their role in evaluating health claims and product comparisons. While advertisers are aware of the need for truth in advertising, sometimes their desire to sell products over-shadows an accurate disclosure of product attributes. Advertisers should bear in mind that inaccurate or vague health claims have the potential to cause economic hardship, illness, and even death. Lastly, marketing strategies used in developing nations should be subjected to the highest standards of truth in advertising. So dairy marketing Strategies in the context of Globalization should be as: 1) Focused Approach: While the product portfolio has been growing, Indian dairy Industry should plan for reach out to newer markets – but the strategy here is more product-specific. 2) Wider Spread: However, as far as other dairy products are concerned, Indian dairy Industry should plan to expand across the board. 3) Create Original Marketing: Re-invent a product with a powerful marketing campaign. No matter if you are selling milk, yogurt, butter, sour cream, or cheese, a truly original commercial or print ad can cause consumers to think of your product in a new light. Whether you are conceiving of the marketing yourself or hiring a top advertising agency, aim for outside-of-the-box thinking. A catchy slogan, a memorable spokesperson or an emotionally powerful commercial can go a long way. Use viral marketing and social media to get your product to the masses without spending an enormous amount on advertising. 4) Focus on Nutritional Value: Use scientific-based guides and studies such as this to convince consumers to consume your dairy product. Associate your product with the study itself. 5) Appeal to the Organic Market: Consumer demand for organic milk continues to grow at an annual rate approaching 20 percent, according to the Agricultural Marketing Research Center. Many people are attracted to products that are free of chemicals and are manufactured naturally. Utilize the organic trend in your product line. Follow the government guidelines to get the organic seal to include in your product advertising and packaging. 6) Introduce New or Unknown Products: Offering consumers something they have never heard of is a sure-fire way to peak interest in a product. There were 448 total new dairy product launches in 2010, according to Dairy Foods. Consider creative yogurt flavors such as Yoplait’s Apricot Mango and Dannon’s Banana Cream Pie. Try new flavors of milk, such as banana or black raspberry, or varieties of cheese that are not well-known in the American market. Consider dairy products with added dietary supplements, such as probiotic, acidophilus or bifidus cultures.

When marketing a dairy product, the most important aspect of your strategy is determining your competition and audience. By establishing these parameters, you can decide what aspect of your dairy business to highlight and where will be the most effective place to advertise to capture your target audience. Understanding the dairy business and products thoroughly will help you discern your advertising assets and weaknesses.

If you thought that all the action in business was concentrated around the e-commerce sector, you could not be more wrong. The unlikely category of milk and dairy products has been seeing some of the most frenetic activity over the past couple of years. Multinational and Indian corporate giants have jumped into the market. Start-ups have cropped up.

Fundraising is taking place at a frenzied pace, both from the equity markets and via private equity funding. And new products and innovations are being launched fast and furious. Meanwhile, the Rs 31,000 crore Amul, managed by the Gujarat Cooperative Milk Marketing Federation (GCMMF) – is aggressively throwing resources to protect its turf. It wants to hit Rs 65,000 crore in revenues by 2020. But Amul is facing unprecedented challenge from all sorts of players. Groupe Lactalis SA, the world’s largest dairy products company, picked up Hyderabad-based Tirumala Milk. A few months ago, ITC had pitched in with its Aashirvaad brand of ghee and a promise to add a lot more products.

Private equity players have pumped in Rs 900 crore already in the past couple of years. Meanwhile, Danone, Nestle and other existing private sector players are adding to their product line-ups and pushing in big money into the market while home-grown dairy cooperatives such as Mother Dairy and Nandini, among others, are also expanding their operations rapidly. And other big global dairy companies are all eyeing the market. Experts estimate that investments worth Rs 15,000 crore will flow into the milk business in India in the next two years.

Milk Market Dynamics

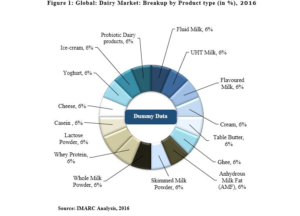

Image source: http://www.imarcgroup.com/files/images/global-dairy-market.png

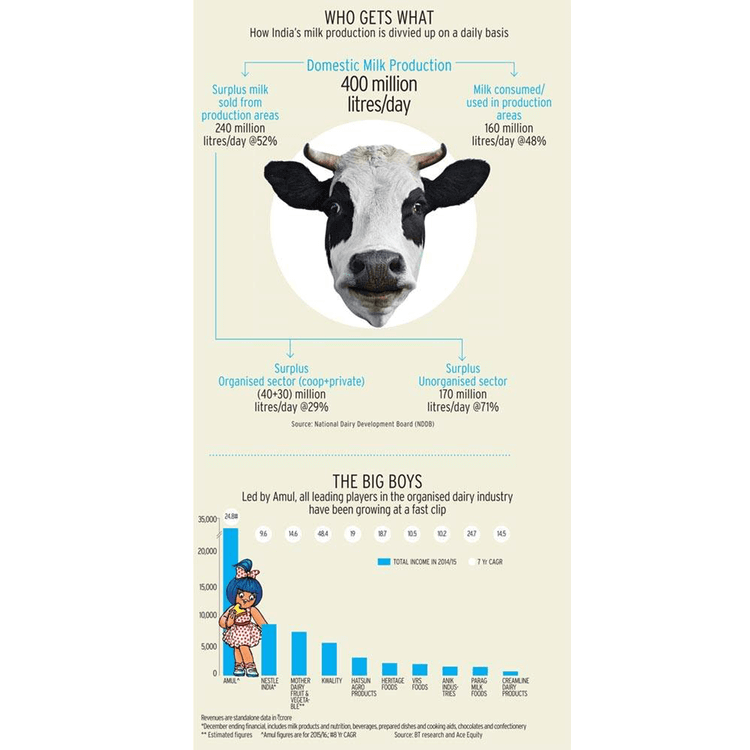

India has always been the largest producer (an estimated 400 million litre per day currently) and consumer of milk in the world. But it remained a boring market largely because the per capita consumption was low, and most of the milk was consumed in its basic, liquid form, or at best as ghee and some butter.

Out of the 400 million litres of milk that India produces per day, 160 million litres per day (48 per cent) is retained by the producers for their own consumption. The surplus milk that is available for sale is around 240 million litres per day, and out of that only 70 million litres per day is being used by the organised sector – consisting of co-operatives such as Amul, Mother Dairy and Nandini (a brand owned by the Karnataka Cooperative Milk Producers Federation (KMF), as well as private sector players such as Nestle and Danone. Over 170 million litres of the surplus milk continues to be with the unorganised sector, comprising traditional domestic. In value terms, the Indian milk economy is worth Rs 5 lakh crore, growing at a CAGR of 15-16 per cent, out of which the organised milk economy is worth Rs 80,000 crore.

Betting on Value Addition

The value added market chart

Image source: http://media2.intoday.in/btmt/images/stories//March2016/milk1_051716031019.jpg

Over 80 per cent of milk consumption in India is that of liquid milk and over 55 per cent of the revenue of large co-operatives, such as Amul and Nandini, comes from selling liquid milk.

(Image source reference): http://media2.intoday.in/btmt/images/stories//March2016/milk2_051716031019.jpg

There are still limited takers for value-added dairy products such as cheese, yogurts or flavoured milk, but this is where much of the action is taking place today simply because of its higher margins, and the ability to differentiate and introduce new products. Equally, the fact that the milk cooperatives did not tap this market until the multinationals came in made it an area where the competition was relatively equal. The Indian consumer – especially the affluent urban consumer – is consuming more value-added products, which bring in bigger profits for dairy companies than raw milk. The phenomenon of working couples, single men and women with high disposable income also provided the impetus to look at the category with fresh eyes. The fact that the Indian cooperatives had largely stuck to basic milk, butter, processed cheese slices and ice cream for many decades, had left a gap in the market that allowed some of the new players to come in with new product offerings.

By taking an in-depth look at your dairy products and the process that goes into producing them, your product’s advantages will become clear. Look at how the product is created, whether you produce, milk, butter, cheese or any other dairy product. If the cows used are fed only natural, hormone-free feed, this is something you will want to promote. If the owners and operators are third-generation dairy farmers or an extension of a business with deep roots and extensive experience, highlight this in your advertising. Understanding the product, the business and the process will help to form your overall marketing strategy. The new players are carving out their place in the segments that include cheese, ice creams, varieties of yogurt and milk-based beverages.

The Chairman of Parag Milk Foods gave out that their strategy is to differentiate and not directly compete with big, entrenched players like Nandini and Amul therefore they decided to move up the value ladder and grab that category completely.

Expand product range in Beverage segment

Dairy products maker Parag Milk Foods expanded its product range with the launch of “Slurp”, a mango fruit milk juice, as part of plans to become one of the largest FMCG dairy organisations. Parag Milk Foods Ltd., Chief Marketing Officer, Mahesh Israni said the company had “technology” at the Palamaner factory to manufacture the fruit juice drinks. The domestic fruit drink market is valued at Rs 10,219 crore of which juice segment constitutes Rs 7,150 crore.

Only 18 percent of the Rs 1,440 crore revenue of Prabhat comes from fresh milk, while the rest is from value-added products such as cheese, milk beverages and yogurts. The company has as many as 67 varieties of cheese, which it sells at retail outlets as well as in institutes.

The retailer’s fastest moving dairy product from her shelves is probiotic milk, but other fast-growing segments include greek yogurts, fresh paneer, farm fresh milk and nut-based milk.

Analyzing demand

One big change, says Jochen Ebert, Managing Director, Danone Foods and Beverages India, the company that introduced a few new sub-categories, such as flavoured yogurt and ready-to-eat custard, is that many things that were earlier made at home are now bought by urban couples and single working women. “Young females who are working find it a good idea to get the yogurt or dahi from outside instead of setting it at home. That means there is an opportunity for commercially produced yogurt and we are focusing on that opportunity,” says Ebert. Danone was among the first to introduce a series of yogurts, but its innovations were quickly copied by his rivals, including Amul. Let us take a look at their promotional video:

Danone India entered the market with its array of yogurts and the conventional dahi in 2009. Its products did get accepted but only in niche stores and among a certain class of consumers. But Danone, says Ebert, entered India with a mindset of creating a market for yogurts and focus on increasing the per capita consumption. Yogurt in India, he says, has a per capita consumption of just 3-4 liter, as opposed to France, Holland, and Germany, which are at 30-40 litre. “The first intention is to share with the Indian population that yogurt or dahi is a fantastic contribution to their diet.” Since cold food supply chain is a challenge in India, Danone innovated and created products with greater shelf lives. In the past year, it has introduced ambient yogurt and milk-based products with six months of shelf life. It has innovated products, such as smoothies, chaas, and lassi, which are packaged in ultra-high temperature (UHT) packs. Take a sneak peek at Danone’s promotion of their fruit flavoured curds:

The most recent launch from the Danone stable has been ready-to-eat-custard. Meanwhile, more stores have started accepting these products now. From being available in just 10,000-odd stores about a year ago, Danone is today available in over 50,000 stores.

( Video link and description: Danone, a leading food company, has launched an innovation in the packaged food industry with its ‘ready-to-eat custard.’ Made with 80% toned milk, it is a 100% vegetarian product and is extremely convenient to use.)

What sells your product? Added values.

Value-added, in fact, is the place where the bulk of the innovations and new product launches are taking place. Both Prabhat Dairy and Parag Milk Foods have set up cheese production units and facilities to produce Ultra High Temperature (UHT) milk and milk-based beverages. Since they are already into production of cheese, they have also tapped into whey protein (a cheese by-product) – much sought after by bodybuilders and fitness freaks around the globe say Shah of Parag.

Nestle, the largest and oldest private milk player globally, has recently launched Greek yogurt, Nestle-a+ GREKYO. Greek yogurt, which is a super concentrated yogurt, is a swooping category in India and is stocked by premium retailers. It is priced considerably higher than other yogurts, but Arvind Bhandari, General Manager (Dairy), Nestle India, is confident that it will pick up. Nestle is present in the entire array of dairy product categories, especially in the value-added space.

Similarly, ITC Foods‘ much talked about entry into the dairy segment finally happened late last year, and that also in the value-added dairy segment, with the launch of ‘Aashirvaad Svasti Pure Cow Ghee’. ITC, in the last few years, has invested significantly in setting up a robust milk procurement network.

Amul’s Forging ahead

But even as private companies are betting on the value-added dairy products, big milk cooperatives have also matched them step for step. The country’s largest dairy products company, Amul, has been investing Rs 800 crore-1,000 crore year-on-year in setting up new milk processing facilities, as well as building its value-added products infrastructure.

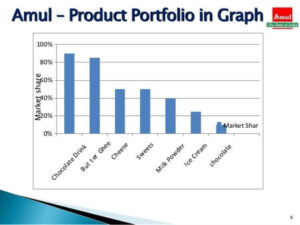

Product portfolio

image source: https://image.slidesharecdn.com/historyofamul-141108054735-conversion-gate01/95/amul-history-and-stats-8-638.jpg?cb=1415425731

Be it ghee, cheese, butter or yogurt, Amul is clearly the market leader in most value-added dairy categories. The branded ghee market, for instance, is Rs 5,275 crore and Amul and Sagar (Amul’s second ghee brand) together command a 30 percent market share.

Apart from cheese, yogurt, and smoothies, many of the state-run co-operatives are also looking at traditional Indian mithais. There is a good opportunity to push healthy Indian sweets into the market that has the promise of being unadulterated. Nandini Milk Products, for instance, is pushing healthy sweets.

Trace your potential customers

Sodhi of Amul has a word of caution for the new-age dairy companies. He says while India does have surplus milk for dairy companies to build a robust business, to be successful in India and get the much-needed volume growth, one has to have a presence in liquid milk. After all, 80 percent of Indians consume only liquid milk!

“The bread and butter have to be milk, the business model will not work,” insists Sodhi.

Discern who exactly you are marketing to and what segment of the market would be most inclined to purchase your dairy products. If your dairy products are produced by hormone-free cows that are free to graze and are provided healthy lifestyles, then you need to determine who these facts will resonate with and who may be willing to pay a little extra for these features. Families in middle to upper-income brackets are likely to be your best clientele. Those interested in what goes into the foods and drinks their children consume and willing and able to pay a little more for your natural and chemical free products are likely a good fit.

Multinationals, on the other hand, are used to operating in a very different way around the globe. In western markets, dairy companies depend on an ecosystem of large corporate dairy farms and bulk of the procurement is done from a single farm. The game, in India, is to aggregate milk from many small-sized farmers, which could lead to inconsistencies in both supply volume as well as supply quality.

More private players are getting into value-added dairy products. Is this the big opportunity now?

Milk demand is growing by 6 million to 7 million tonnes per year. Last year, we even exported 100,000 tonnes of skimmed milk powder. With increasing disposable income, milk’s product profile is changing in urban centres. You will see more yoghurt, ice cream, butter and cheese being consumed. Even Amul has diversified into the value-added segment. Smaller cooperatives are still largely restricted to liquid milk, though they are diversifying into traditional sweets. With overall growth, we will see more such diversification. The pasteurised and organised sector is growing base. This is where private players are also finding space and opportunity.

What are the other opportunity areas?

There is increasing emphasis on health. We are seeing preferences shifting from sugared milk drinks to chhach or yogurt-based beverages, even slim milk. Cooperatives are already enriching milk with Vitamin A. Mother Dairy’s token milk, for instance, has Vitamin A.

While Shrirang Sarda, Sarda Dairy Farms, is a third-generation entrepreneur, Rajesh Singh, of Blissfresh, is a former banker who quit his cushy job to become a milk entrepreneur. Both Sarda and Singh have created a farm-to-home model, where all the milk is sourced from a single farm owned by them, processed and delivered at the doorsteps of the consumer. A one-litre pack of Blissfresh costs Rs 70 and since all the milk is sourced from a single farm, Singh claims that the protein and fat content of the milk is far higher than other mass brands which follow the collection method. Video link:

Be it Sarda Farms, Blissfresh or Faridabad-based Murginns, most entrepreneurial activity is happening at the premium end. Murginns, for instance, sells a premium range of yogurts, flavored milk and flavored butter in Delhi. In 2013, when the brand launched flavored butter in different flavors, there was hardly any competition. However, when the likes of Amul got into space, managing scale became a challenge.

Though premium milk delivered to homes straight from the farm enriched with proteins and vitamins or a tub of gourmet butter, does have takers, but as businesses, they will continue to remain niche. According to industry experts, these are not scalable models.

With global dairy majors looking at India as a lucrative investment destination and home-bred dairy companies all set for the next level of growth, the sector is expected to witness some real action with far too much place for multiple players to operate. After all, two-thirds of the surplus milk available is still in the unorganized sector.

Marketing techniques and campaigns of Top players:

Promotional videos

When someone visits your website, the video is an exciting and excellent method of communicating with them. Watching and listening to well-produced video content is more engaging than reading pages of text and requires much less effort. Most people also remember information which is conveyed in an audio/visual format better than information they read. Many website owners who currently use video marketing find that adding video increases return visits to their website, especially if they are adding videos regularly.

Amul slays it with this slice of life Facebook ad revolving around two grandparents preparing for a visit from their grandchild. It is honest, relatable and sweet as hell! Receiving millions of views within days of the release—–

Mango Cheesecake using Nestle milkmaid:

Chilled Lime Pie:

India’s per capita consumption of milk at 97 litres a year is way below that of western countries like the US, which boasts per capita consumption of 285 litres per year, or the European Union, which consumes 281 litres per capita per year. The second reason is that finally, global prices of milk are dipping because of overcapacity, while the Indian market is still growing, both for basic milk as well as for value-added products. India is strategically a great place to be in, especially for international players. With milk available in surplus and consumption of milk products on the rise, they can not only tap the Indian market, but also use India as a base to serve other global markets.

Setting Up a Direct-to-Consumers Model

The digital and e-commerce revolution has drastically changed how dairy brands are reaching their customers. Instead of using wholesalers or retailers, direct-to-consumer model helps sell dairy products directly to the end customer.

The resulting shift in power has been devastating for traditional retailers, and yet simultaneously, some of the most innovative and successful dairy companies of the last decade have been born from this movement. Namely, Country Delight delivers fresh, unadulterated dairy and food products directly to the doorstep of the consumer. It launched with selling milk and has since expanded to other dairy products, such as curd, eggs, ghee, bread etc. and even staples. Other companies like Amul and Nestle’ are using e-commerce to deliver products directly to consumer.

The traditional supply chain includes a supplier, manufacturer, wholesaler, distributor and retailer. The retail sales model often involves lengthy negotiations at each stage of production or delivery, and it typically results in a long lead time for product launches and an even longer wait for the customer feedback loop to kick in.

Direct- to- consumers model ignores that traditional standard. Companies can cut out the middleman, the wholesalers, and the distributors and instead harness the power of social media and the rise of e-commerce to sell their products directly to end consumers.

Direct-to-consumer sales model eliminates the barrier between producer and consumer, giving the producer greater control over its brand, reputation, marketing and sales tactics. Plus, it helps the producer directly engage and therefore learn from their customers. This model can be implemented in different ways by manufacturers. Online marketplaces and platforms such as Amazon and eBay offer product listings and direct sales to end customers.

Alternatively, manufacturers can operate their own online shop or use social media platforms to offer products in the context of Social Commerce. Numerous start-ups pursue a pure direct-to-consumer approach and demonstrate considerable growth, making them attractive acquisition targets.

Why Dairy Manufacturers are Opting for the Direct-to-consumers Marketing Strategy

Shipping dairy products imposes major challenges mainly due to the perishable nature of most of the dairy products. Managing the shipping involves managing the inventory, distribution network and supply. Each of the steps require proper storage of the dairy products.

During the pandemic, the supply chain of dairy products was hindered causing major losses to the manufacturers. Hence for better supply management and in order to gain higher profit margins and brand loyalty, dairy product manufacturers are opting for direct-to-consumers marketing strategy.

Direct-to-Consumers Model Proving Most Efficient for Milk Products and Tetra Milk Marketing

Although dairy products are highly perishable in nature a lot of efforts and research has been put into increasing the shelf life of these dairy products.

A number of thermal and non-thermal processing technologies are incorporated to increase the shelf life of milk and milk products. These techniques help the dairy products to last longer under ambient storage conditions.

Milk and milk products manufacturing companies have come up with their new range of tetra pack milk and other milk products with an increased shelf life. But even these products require ambient storage conditions throughout the supply chain process. Most of these manufacturers are now using direct-to- consumers GTM model for marketing their products. This provides them direct access to the consumers; manufacturers achieve higher margins by eliminating the middlemen from the picture.

Milk products and milk tetra pack manufacturers are no longer restricted by geography when selling direct-to-consumers. They can go global by just selling to the right customer segments, in the right market. Adopting a direct-to-consumer strategy is beneficial from a financial as well as operational standpoint.

One of the biggest challenges that dairy businesses face under a traditional retail model is gaining access to the markets where they want to sell their products. In many cases, large regional retailers won’t agree to carry a product unless it already has a lengthy history of proven sales and insist on exclusivity agreements that limit where else the items may be sold. In a direct-to-consumers model, businesses can bypass these gatekeepers and offer their products straight to consumers.

Although currently the retail distribution channel accounts for around 60% of the dairy products market share, many dairy companies are now adopting the direct-to- consumer sales channel for better customer service and increased market reach. Some of the prominent dairy products manufacturing companies delivering products directly to consumers are: Oppo, McQueens Dairies, DairyDrop, Butlers Letterbox Cheeses, Pong cheese, Eweleaze Dairy Organic, Ben & Jerrys, The Modern Milkman and Amul.

How are Retailers Competing with the Direct-to-Consumer Model?

With more and more companies adapting the direct-to-consumers model, the businesses of traditional retailers have been adversely affected. However, progressive retailers, who wish to remain relevant, have adapted their business model to cater to non-linear buyers. The multi-channel, or omni-channel, shopping experience they offer includes:

- Website

- Mobile app

- Presence on social media

- Presence on price comparison sites

- E-payment gateways

Brands Benefit from Direct-to-Consumers Model

- The direct-to consumer model proves to have many advantages over the traditional retail sales model.

- Cost Savings: Moving to a direct-to-consumers GTM model is a smart strategy for decreasing overhead costs. Manufacturers following this model have a lot more flexibility in terms of operational costs and logistics, pricing structures and other considerations

- Brand Resonance: Many leading brands have made names for themselves by offering everyday products that are more affordable, more sustainable or simply more exciting than those found in traditional retail settings

- Increased Personalization: The direct-to-consumers GTM model offers better consumer relationship and consumer feedback data

Challenges Faced by Dairy Companies While Adapting the Direct-to-Consumers Model

The dairy industry is facing major challenge as consumer preference is leaning more towards plant-based milk, meat alternatives and vegan offerings. Hence, manufacturers are trying to enhance the nutritional profile of dairy products by adding health-enhancing ingredients. They have to find and use ingredients that can offer functionality and shelf life in the most minimalist way possible.

Other challenges faced by the dairy manufacturers include:

- Marketing and Pricing: Direct-to-consumer model involves managing production as well as entire supply chain by the manufacturer which is not only expensive but also requires huge man power and robust technical support. This adds to the overall cost making the products more expensive compared to the retail counterparts. Also, marketing, advertising and customer acquisition cost further make the products costlier.

- High Cost of Handling and Distribution: In a direct-to-consumers model, manufacturers can avoid having to deal with a lot of external

- Intermediaries. But this in turn means they must adapt to manage many internal processes. These include orders and shipments, agreements with transport agencies, online payments, returns and exchanges and 24/7 customer support, not to mention each of their associated costs.

Dairy Direct-to-Consumers GTM Model Evolves in the Future

The direct-to-consumers model mainly relies on e-commerce and with the continuation of e-commerce revolution that’s been underway for the past 25 years, this trend is expected to maintain traction over coming years. Since a direct-to-consumers GTM model means cutting retail partners out of the process, it also means a business won’t have to invest the time it takes to grow their presence in one regional market at a time. With a digital selling platform, direct-to-consumers dairy businesses are everywhere at once; accessible to anyone with an internet connection.

That makes adding new products to their line-up simple and their reach immediate. They also don’t have to worry about maintaining relationships with countless competing retailers, and don’t have to worry about one partner cutting into the sales of another. Currently many dairy product manufacturers are exploring the direct-to- consumers GTM model, this number will continue to increase as more and more dairy manufacturers become aware of the benefits of this model.

Over coming years, the direct-to- consumers GTM model is expected to become more structured with many new dairy product manufacturers opting for direct-to- consumer’s sales channel via e-commerce. This way the dairy businesses will gain complete and direct control of their brand and its image. The direct-to- consumers model will help the dairy manufacturers embrace a robust e-commerce architecture by letting them select an experienced partner for warehousing and distribution needs.

Many dairy product manufacturers are investing on company websites and mobile applications which will help them have better control over order deliveries and establish a better personalized customer experience. Hence technology and e-commerce are expected to play important role in shaping the future of direct-to-consumers GTM model in the dairy industry.

Milk Marketing – The Early Days

The White Revolution transformed India into a world leader in milk production. Dr. Varghese Kurien, the Milkman of India, took matters into his own hands to make ‘milk’ cool in an era of fancy colas. He led the ‘White Revolution’ under Gujarat-headquartered National Dairy Development Board (NDDB) executed it in 3 phases. Thus came around one of the first roots of milk marketing in India.

This phase saw some of the most memorable campaigns in the milk marketing segment – Doodh Doodh’ conceptualized by Kurien and executed by FCB Ulka in 1996 for the Operation Flood program, Amul’s ‘Manthan’ campaign from 1996 which includes clips from Shyam Benegal’s film (1976) with the same title, telling the story of the White Revolution. The iconic ad campaign was revived by Amul and Draftfcb Ulka in 2011 and later in 2013 showing the progressive journey of women dairy farmers.

Cut to 2020, Amul became the first brand to trigger nostalgia by re-launching its 90s advertisements under the #AmulClassics series, including the ‘Manthan’ ad during the reruns of Ramayan and Mahabharata during the pandemic. Like the traditional mediums, social media has been witness to a new chapter of milk brands marketing, creating a different kind of revolution.

Milk Brands’ Social Media Marketing

While majors like Amul, Nestle, and ITC massively sell the proposition of the ‘goodness of milk’ through social media, local and medium-scale dairy businesses catering have been concentrating on the ‘desi’ strength and nutrition that comes from milk consumption especially when a health crisis loomed large.

Milk, the ‘IMMUNITY Booster’

With excess emphasis on immunity in the last one year, it has been a consistent theme in dairy brands social media marketing.

ITC’s Aashirvaad Svasti Milk celebrated World Milk Day in June 2020 with the launch of an ‘Immunity Song’ for kids in association with Alive India. With this initiative, the brand aimed to create awareness about the importance of immunity for kids with its new Vitamin A fortified product. The farmer-owned dairy cooperative has also been reported to have doubled its marketing spends during the peak of the pandemic to get the milk supply going and generate brand recall through media communication highlighting the ‘immunity’ quotient. Adding further to its bouquet of immunity-boosting milk products like ‘haldi doodh’, Amul also rolled out ginger and tulsi milk. Mother Dairy too harped on the enhanced immunity wave with the launch and marketing of its Butterscot Flavoured Haldi Milk.

Meanwhile, Nashik-based Sarda Farms which recently expanded its operation in Mumbai claims to deliver fresh cow milk directly from the farms at the consumer’s doorstep, creating an old-world experience. Although the company has established itself as a dairy, its primary focus lies in promoting the ‘fresh cow milk’ as the ultimate immunity booster visible across its social handles with hashtags like #healthymilk #puremilk #FromFarmToHome.

Creating Hyperlocal Demand

The concept of a2 Milk – cow milk that is free of a form of beta-casein proteins called A1- has been adopted by various local players. Vedic Gir Cow’s A2 Milk serving in Ahmadabad is leveraging social media to spread awareness about the advantages of a2 over a1 induced milk and create a demand for its products in the region.

Similarly, Gwala’s A2 milk boasts on social media the significance of fresh cow milk and how being ‘purer’ than its competitors gives them an edge. Apart from marketing cruelty-free (Ahimsa), Single Sourced A2 Milk from Naturally grazing, grass-fed Gir Cow, the company also shares content alerting consumers of milk adulteration methods and practices statistics. Becoming India’ first brand to introduce camel milk, Rajasthan based Aadvik Foods has garnered a significant amount of fan following. From sharing crucial information about vaccinating the camel herd to sharing consumer feedback across social media with an objective to expanding its consumer base, the brand has been quite active in indulging in strategic communication.

Power of Nutrients

This marketing theme is majorly based on the good ol ‘doodh peene k faidae’ funda.

Parag Milk Foods’ owned Gowardhan in a #DidYouKnow format educates its followers about the various aspects of protein-induced milk components and how it’s beneficial for our body. Milklane positions itself as a toxin-free and antibiotic safe milk with no adulterants or preservatives. The creatives churned by the brand majorly highlight the nutrients milk carries and why is it cooler than softer drinks for kids. Aadvik Foods never misses an opportunity to specify product benefits keeping the exclusiveness of ‘camel milk’ at the core of its communication strategy.

Promoting Quality Milk, Affordability & Safety Practices

In November 2020, post the launch of its premium milk offering – Aashirvaad Svasti Select Milk in Kolkata, ITC launched a ‘Doodher Report Card’ – a daily quality assurance report of the pack of milk that consumers would buy. Highlighting this offering, Aashirvaad launched a TVC, which features popular TV show hostess and actress Rachana Banerjee as the brand ambassador. Through this ad film, Rachna Banerjee has helped put the spotlight on the importance of quality as well as the taste of milk.

Sarda Farms too particular focuses on the milk quality and the health factor that comes with it. The brand speaks about the benefits of its product and how the company takes great care in sanitization drives and cow feeding. Further, keeping the white-golden-hued theme intact on social media, the farm-based dairy company looked to garner eyeballs by customizing milk according to consumer’s choices and demands. For instance, lowering the price to make the milk affordable to its target audience during the lockdown.

Owing to the rising concern around COVID-19, brands took to assure consumers about the various safety measures taken while processing and delivering milk. Pride of Cow leveraged the power of social media to put out a clear message of adhering to the safety standards at each step.

Influencer Marketing & Live sessions

A large chunk of Sarda Farms’ Instagram communication is occupied by Influencer tie-ups, especially with mom bloggers discussing the health benefits of milk across age groups. Live sessions with experts and nutritionists are executed to burst myths around milk and solve consumer’s queries.

On the other hand, Pride of Cows roped in Bollywood diva Kareena Kapoor to increase the credibility around its products and assure the consumers of its quality and pureness.

MilkLane too has adopted the technique for generating product relevance among its target audience and occasionally ropes in influencers to talk about the product specification while keeping human interest stories at the center.

Be it leveraging the festive occasion or any occasional set-up, Mother Dairy has been heavily promoting the milky components through its social media handles while also roping in chef bloggers. For instance, during Diwali the brand brought on board few experts and food influencers of contest announcements where they urged consumers to make delicacies using Mother Dairy Milk.

Moment Marketing & Seasonal Greetings

Almost all milk brands have been managing to churn out relevant content around topicals and trending moments to join the moment marketing bandwagon. While Amul has pioneered the moment marketing trend, other brands too have been highlighting the importance of milk consumption by integrating their product with trends and occasions.

On the occasion of World Milk Day, Pride of Cows rolled out a consumer engagement activity on social media asking parents to #RaiseAGlass and share a picture of them with their kids, drinking milk. Apart from launching consumer engagement activities, the brand is also seen actively hopping on the topical wave and get talking about what’s been trending at the moment. Thereby not losing an opportunity to market its product in a fun and quirky way.

With social media platforms democratizing communication for all, it has been prudent in bridging the gap between mass campaigns and micro tactics for direct to consumer communication – be it the bigger FMCG brands or the local dairies. Owing to a level playing field on digital, both the sets have been reaching out to their respective target audiences while making milk ‘cool’ yet again for the new age population.

From topical trends to influencer marketing and celebrity endorsements, dairy brands are leveraging social media marketing, keeping the charm of Manthan days alive on digital.

Future in Dairy Industry: D2R & D2C business models

The milk industry in India is an extensive network of farmers, dairy cooperatives, and private players. To increase profitability levels and safeguard the industry’s future, Direct to Retail (D2R) and D2C (Direct to Consumer) or DTH (Direct to Home) business models are now gaining momentum. The largest dairy companies in the world like Dairy Farmers of America, Fonterra, Nestlé, Amul (GCMMF), and Danone all actively adopt these models.

Direct to Retail (D2R): Under the D2R dairy model pioneered by Amul founder Dr. Verghese Kurien, middlemen are effectively eliminated, as companies/brands procure milk directly from farmers, pay them commensurately, process the milk, and sell to end consumers through company-owned milk parlor chains and retail stores. Examples of prominent D2R players are the dairy co-operatives and milk federations of respective states (like Mother Dairy in West Bengal, Aaarey in Maharashtra, Aavin in Tamil Nadu, Nandini in Karnataka, etc.) and private players like Heritage Foods, Creamline Dairy Products, and Schreiber Dynamix Dairy.

Direct to Consumer (D2C) or D2H (Direct to Home) – The rise of ‘Milktech’ Startups: This model has gained popularity during the recent COVID-19 pandemic, as consumers have shunned physical stores and favored direct door-delivered purchases. Prominent examples of this model include Kiaro – a Hyderabad-based app-driven organic dairy products brand, Parag Milk Foods’ ‘Pride of Cows’ in Mumbai and Pune and Milk Mantra’s Milky Moo in Bhubaneswar and Cuttack.

Disrupting the industry in recent times, new-age start-ups have changed the game. Attracting global investors, they have redefined the market by offering customized tech-focused services, with flexible options of pre-payment and long-term subscriptions.

The future of the dairy industry is D2R and D2C.In these business models, product quality is standardized and maintained in conformity with international standards and certifications, and the network farmers get a better price. With regard to the milk industry, these private players use state-of-the-art infrastructure, world-class farming practices, advanced technology, and packaging techniques.

How Industry can overcome these challenges

- Process Excellence

Dairy products are a perishable food item. Hence, they have to be refrigerated in robust cold chains and sold quickly to preserve product quality. The short time to market and the quick flow of products differentiates the milk industry from others. Time and information management is key to reducing waste and improving the quality of delivered dairy products, and this is where a lean manufacturing consultant can bring about improvements.

- i) Define SOPs/ Process Automation:

Process automation is what IT systems can do to optimize and make your dairy business effective, helping to quicken internal processes by eliminating human error. This could be in the form of Artificial intelligence (AI), Machine Learning (ML), Internet of things (IoT), ERPs, chatbots, packaging & handling equipment, etc. All of these helps to save man-hours, which could be better utilized in more critical processes.

Implementing a state-of-art dairy system is the dream of every dairy farm consultant. The industry continues to be plagued by the scarce availability of standardized process documents leading to lack of proper communication (internal & external), mismanagement in feed management, sanitizing practices, input vs output, waste management, manpower utilization, breed selection & tracking, value addition & dairy farm profitability. Dairy consulting services try to address all of these issues and more.

Dairy consultancy services recommend best practices for milk production and procurement, products and procedures and machinery design and maintenance support. They draw up techno-economic feasibility reports for dairy enterprises covering the while milk production ecosystem, and provide R&D assistance for product processes, quality assurance & product testing, including feed analysis and evaluation.

SOPs in Dairy Industry: Standard Operating Procedures (SOPs) in dairy are instructional roadmaps for the entire dairy’s operations. Dairy businesses worldwide widely use process automation that overcomes the shortcomings of existing methods. Dairy consultants try to ensure that SOPs and process automation covers the following facets of dairy businesses, i.e.

- General herd health management including vaccination and treatments

- Reproduction management (deliveries through timed AI protocols)

- Milking management (procedures, parlor setup, cleaning, sanitation)

- Veterinary Assistance

- Productivity management (including breed selection and tracking)

- Feed management (including newborn calves)

- Waste management (including newborn calves)

- Maintenance crew

- Organizational blueprint (including manpower utilization)

- Production and supply chain safety

- Location management (diagram or maps of where animals and facilities are located)

Initially, dairy employees are enthusiastic about process improvement measures, but their interest gradually wanes over time. This usually occurs when monitoring and feedback mechanisms are not built into the SOPs.

- ii) IT System Integration of SOPs:

A strong IT infrastructure forms the core of all business processes. IT applications can significantly reduce operating costs, also boosting process accuracy and automation.

Integration of ERP with SOPs: Buyers need to know when products are available for ordering and when they will be delivered. This is where e-commerce for dairy comes in through live, interactive online sales portals that are fully integrated with the source of all business data and logic: ERP (a software-driven information system fueling all your business processes). The integration of ERP and SOP enables software programs to be designed and customized according to predefined operational procedures and business specifications. Examples of effective ERP systems for the dairy industry are SAP and Microsoft Dynamics.

Essential IT SOPs necessary to control the entire diary processing system

System Maintenance SOP: This consists of system controls that ensure periodic system checks and maintenance. Thus, this SOP describes system monitoring procedures and process decommissioning systems. We have to always ensure the integrity of any data contained within these systems.

Physical Security SOP: are controls in place to secure access to building premises. It manages digital cards and codes, building alarm systems and intrusion control. It also includes environmental controls to safeguard data installation systems, i.e. the fire detection, temperature and humidity controls.

Logical Security SOP: This refers to data security protocols such as VPNs, Firewalls, and Virus protection apps. This includes password format or aging, and technical controls to improve security like password-protected screen savers.

Incident and Problem Management SOP: This takes care of the process for managing any incidents or problems related to regulated computerized systems. They typically describe how incidents and problems are recorded, analyzed, and resolved.

System Change Control SOP:Critical to the management of regulated systems, this SOP could be the most problematic of all. The system change control procedure is used during the change of any computerized component, typically using a form or template to allow the documentation of the change control. The process demands that the change rationale and steps be documented, after which a system impact assessment is carried out. A revalidation plan if any is documented, along with executable test scripts and evidence. The rollback path, review, and approval process (pre and post-execution) should be clearly defined here.

Configuration Management SOP: Often used in conjunction with change control, this SOP governs how system configurations are regulated, managed, and documented. A standard process has to be laid down so that configuration changes can be reviewed and approved.

Disaster Recovery SOP: Whenever a disaster occurs, this SOP ensures that data is properly protected and disaster recovery is carried out in a timely and controlled manner. The SOP has to clearly define a disaster and its parameters, and provide an overview of the disaster recovery plan which should be tested at regular intervals.

Backup and Restoration SOP: The final and possibly the most vital SOP is backup and restoration. The procedure should clearly outline the schema and methods used to protect data and systems. Creation, maintenance, and verification of backup jobs should be clearly defined. A restoration request process should be defined and tested periodically to ensure complete data restoration is possible. Last but not the least, long-term archiving of data should be addressed in this SOP as well.

- Digital Sales Techniques for rapid expansion

Adopt D2R (eliminate distributors and directly reach out to Retailers)

Under a Direct to Retail D2R digital sales model, dairy companies procure milk from farmers and then use a transparent, digital selling mechanism (example: online sales portals), eliminating all middlemen. Customers can educate themselves on the go, and digitally purchase the latest dairy products through live web stores and mobile apps. Buyers can place an order at night, and fresh milk & dairy products are promptly home delivered the next day by 6 am.

Data Analytics-centric Dashboards keep up the sales momentum

Data-driven analytical dashboards provide statistical insights to customers and clients digitally, helping to drive up sales. Operational dairy processes, data, and customer information are entered into these user-friendly web platforms. There are several B2B e-commerce platforms and E-hubs like dairy.com which serve as digital marketplaces, providing dairy producers and retailers the opportunity to find new customers or deal with existing customers online.

D2C business model (via e-commerce directly sell to end consumers)

Direct to Consumer digital selling techniques give the producer greater control over the brand, reputation, marketing, and sales strategy. Additionally, it helps the milk producer to remain agile, directly engaging, and continuously learning from customers. Here, digital advertising in interactive social media channels is the norm, i.e. Facebook marketing, Instagram and YouTube video ads, and customer-created marketing content (which in turn spurs them to make online purchases).

By integrating your e-commerce solution with ERP, you can improve your sales standing. Real-time product and logistics data (like current and future inventory) are displayed in your web store, and all processes and data can be effectively managed from one centralized location. This automatically helps to meet and generate current and future buyer demand.

What does the future hold? Dairy E-Commerce set to rule the roost

Tech-backed milk and milk-product delivery platforms are likely to grow even further over the next few years. Leading players will focus on delivering an enriching shopping experience through one consolidated umbrella app. These platforms will go all out to stock and deliver milk, milk products, vegetables, groceries, and other everyday essentials, including niche, premium products like camel milk which are rapidly gaining in popularity.

Growth Opportunities multiply post COVID-19

The massive rise in internet penetration and the recent COVID-19 pandemic has presented huge growth opportunities for digital sales of dairy and milk-based products. Fulfillment options such as click and collect and on-demand delivery has grown exponentially, as every consumer is now ordering fresh perishables online daily. All this is leading to a self-sufficient and viable dairy ecosystem, which is a win-win proposition for all. Hopefully in the next two decades, as the market becomes more defragmented, supply chains strengthen and innovations rise, India would transform into a global dairy superpower with dairy production at its peak.

https://www.pashudhanpraharee.com/challenges-and-oppertunites-of-dairy-sector-of-india/

COMPILED & EDITED BY -B.RAGUNATH,DIGITAL MARKETING ANALYST,BENGALURU

REFERENCE-ON DEMAND