Recent Status of Indian Meat Industry – An Overview

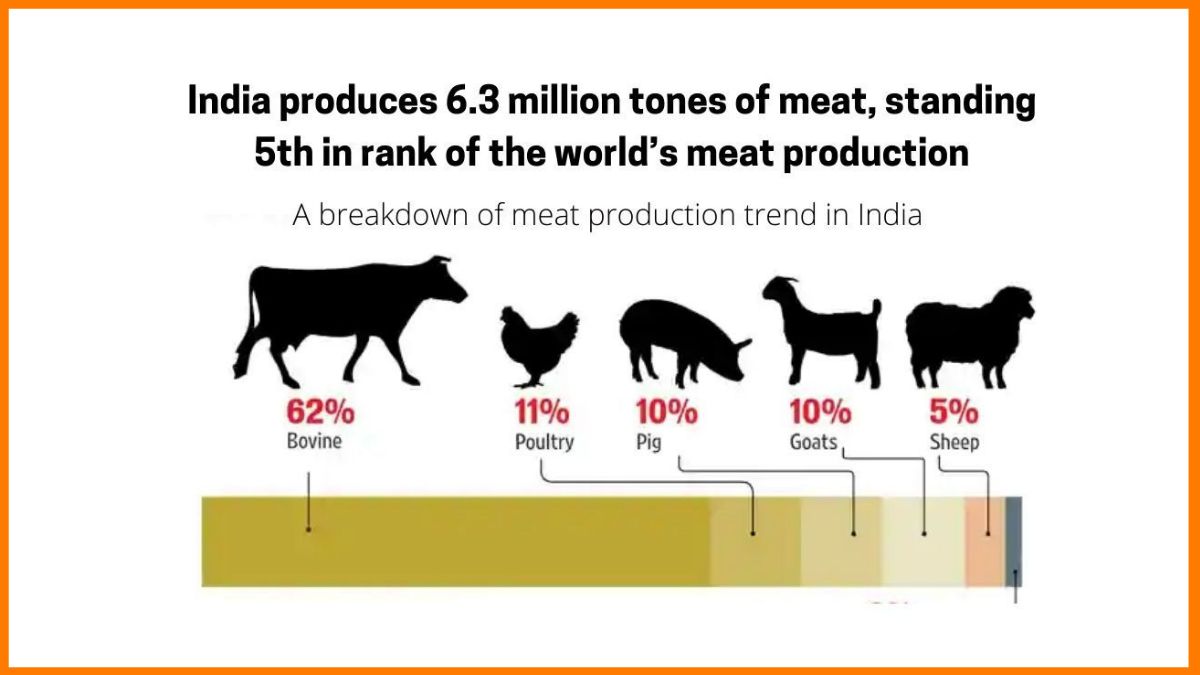

The meat production industry is a vital part of the Indian agricultural setup. According to a research, meat production in India is estimated at 6.3 million tons annually and is ranked 5th in the world in terms of production volume. India is responsible for 3% of the total meat production in the world. The nation has the world’s largest population of livestock at about 515 million.

The meat production segment has witnessed a healthy growth rate. It is known for generating reasonable returns for the producers. In India, beef and pork serve as valuable nutrition-filled consumables and are available at relatively lower prices. Almost 70% of the Indian population is non-vegetarian. The per capita meat consumption in India every year is around 5.2kg. Chicken and fish have the highest consumption rate. The consumption of poultry meat in India was over 3.9 million metric tons in 2020.

Meat Industry in India

The meat industry handles the slaughtering, processing, packaging, and distribution of animals such as poultry, cattle, pigs, sheep and other livestock.

While India has an abundant supply of meat, the meat processing industry is still emerging. Meat processing covers a spectrum of products from sub-sectors comprising animal husbandry and poultry farms, to bulk frozen meat, chilled and deli meat, packaged meat, and ready-to-eat processed meat products. In the present scenario, there is a large scope for meat processing in poultry as well as in red meat. In fact, the poultry industry has made considerable progress by developing and marketing value-added products.

Thus, the Pink revolution (refers to the modernization or technological revolutions of the meat and poultry processing sector in India) is still a task in the making in India.

The Indian Meat Market

India exports more than more than 7,000 metric tons of poultry meat to other countries. Livestock trading in India is regulated by the state governments. India has the lowest per capita meat consumption in the world. It was just 5.6 kg in 2013, whereas the global average was 33.2 kg in that year. The Indian meat market mostly focuses on fresh meat; frozen meat is mostly exported.

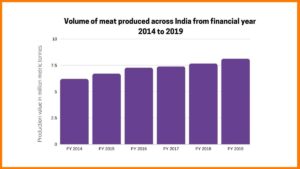

The volume of meat produced from 2016 to 2019 in India.

India has a large resource pool of animal castings and other by-products. The meat industry in India grew substantially during the periods of 2006-2007 and 2012- 2013. India is the second largest producer of buffalo meat in the world. The poultry meat segment is the largest sub-sector in the country’s meat industry and owned almost 50% of the total meat production in 2012-13. It is followed by beef/buffalo meat, goat meat, pork meat, sheep meat, and lamb meat.

Uttar Pradesh (UP) is the largest meat producer followed by Andhra Pradesh, West Bengal, Maharashtra, and Tamil Nadu in the specified order. Sustained income and economic growth, a growing urban population, rapidly growing middle class, changing lifestyles, improvement in transportation and storage facilities, and the rise of supermarkets in rural towns are fueling the rapid increase in the consumption of animal-based food products in India.

Current scenario

- According to the Agricultural and Processed Food Products Export Development Authority (APEDA), India’s buffalo meat exports have fallen 9% in 2018-19 from a year ago to the lowest level in six years.

- The present meat consumption per capita of around 6 grams per day will improve to 50 grams a day in the next decade or so. When such phenomenal increase in meat consumption occurs, the sector will witness a tremendous growth.

- Despite India’s large livestock population, India accounts only around 2 percent of global market.

- China had stopped buying Indian meat on fear of the foot and mouth disease a few years ago.

- Exporters said the devaluation of currencies of Brazil and Argentina had also made Indian supplies less competitive.

- China was a bulk consumer a few years ago and there was a safety net for the industry in terms of consistent volume of trade.

Potential of meat industry

- India is having a good potential for meat production because of large livestock population.

- About 20.5 million people depend upon livestock for their livelihood.

- Livestock contributed 16% to the income of small farm households as against an average of 14% for all rural households.

- Livestock provides livelihood to two-third of rural community.

- It also provides employment to about 8.8 % of the population in India. India has vast livestock resources.

- Livestock sector contributes 4.11% GDP and 25.6% of total Agriculture GDP.

Export potential

- The meat industry is slowly yet steadily catching pace on the global front also as India exports both frozen and fresh chilled meat to more than 60 countries of the world.

- Meat exported from India is risk-free, lean, nutritious and competitively priced meat.

- It has resulted in consistent, high compound growth rate in the export volumes.

- The major item of export includes de-boned and de-glanded frozen buffalo meat, which accounts for 97 per cent of the total meat export.

- The major market for Indian buffalo meat is Malaysia and Egypt and for sheep and goat meat are UAE, Iran and Jordan.

- India also exports a small quantity of processed meat to Thailand, Yemen, and Japan and poultry products to Saudi Arabia, Oman, Kuwait and Qatar.

- Uttar Pradesh state has emerged as the major exporter of buffalo meat followed by Punjab and Maharashtra.

- The value addition to slaughterhouse by products generate additional income as well as the costs of disposing of by products can be minimized.

- There is huge potential in this sector for economic development of country through increasing exports so the policy makers should adopt critical measures at every stage to encourage and support this vital segment of the Indian agriculture.

Challenges

- Productivity of farm animals:

- It is one of the major challenges.

- The average annual milk yield of Indian cattle is 1172 kg which is only about 50 per cent of the global average.

- Diseases and infections of livestock:

- The frequent outbreak of infections like the foot and mouth disease, black quarter infection, and influenza severely impacts livestock health and lowers productivity.

- Feed & Fodder issues:

- Livestock derives a major part of their energy requirement from agricultural by-products and residues. Hardly 5% of the cropped area is utilized to grow fodder. India is deficit in dry fodder by 11%, green fodder by 35% and concentrates feed by 28%. The common grazing lands too have been deteriorating quantitatively and qualitatively.

- Greenhouse gas generation:

- The generation of greenhouse gases by the humongous population of herbivorous animals in India.

- Reducing the emissions through mitigation and adaptation strategies is a major challenge.

- Breeding issues:

- Crossbreeding of indigenous specieswith exotic stocks to enhance the genetic potential of different species has been successful only to a limited extent.

- Crossbreeding of indigenous species with exotic stocks to enhance genetic potential of different species has been successful only to a limited extent.

- Limited Artificial Insemination services owing to a deficiency in quality germplasm, infrastructure and technical manpower coupled with poor conception rate following artificial insemination have been the major impediments.

- Health and occupational hazards:

- Unregulated meat markets, tropical climate, inadequate slaughterhouse hygiene measures, and the lack of surveillance of meat-borne diseases enhance the risk of health-related and occupational hazards.

- According to reports, there are about 8000 registered and more than 20,000 unregistered slaughterhouses in the country and most of them are devoid of basic amenities like light and ventilation.

- Moreover, the slaughtering and carcass-dressing processes are performed in open areas in highly unhygienic conditions following which the meat is sold with little or no veterinary inspection.

- Unorganized sector:

- The meat production segment is largely unorganized. Traditional production systems and disorderly practices have spoilt the reputation of the Indian meat industry.

- Except for poultry products and to some extent for milk, markets for livestock and livestock products are underdeveloped, irregular, uncertain and lack transparency. Further, these are often dominated by informal market intermediaries who exploit the producers.

- slaughtering facilities are too inadequate:

- About half of the total meat production comes from un-registered, make-shift slaughterhouses. Marketing and transaction costs of livestock products are high taking 15-20% of the sale price.

- Financial issues:

- Livestock sector did not receive the policy and financial attention it deserved. The sector received only about 12% of the total public expenditure on agriculture and allied sectors, which is disproportionately lesser than its contribution to agricultural GDP.

- The sector has been neglected by the financial institutions.

- The share of livestock in the total agricultural credit has hardly ever exceeded 4% in the total (short-term, medium-term and long-term). The institutional mechanisms to protect animals against risk are not strong enough.

- Insurance:

- Currently, only 6% of the animal heads (excluding poultry) are provided insurance cover. Livestock extension has remained grossly neglected in the past.

- Only about 5% of the farm households in India access information on livestock technology. These indicate an apathetic outreach of the financial and information delivery systems.

Measures needed

- A national breeding policy is needed to upgrade the best performing indigenous breeds.

- Measures should be taken to increase the meat production efficiency of different species of animals using the improved management practices.

- Adoption of improved shelter management practices can reduce the environmental stress.

- New breeds should be developed for meat production with higher feed conversion efficiency, faster growth and disease resistant.

- Health management practices should be followed for prevention of diseases and economic loss to the farmers.

- Regular prophetic health measures should be carried out against infectious diseases.

- Regular screening of animals should be carried out against disease such as tuberculosis, brucellosis, salmonellosis etc.

- The livestock market yard should have basic facilities for feeding, watering and holding animals for days.

- By vertical integration with meat processing industries the middle men can be eliminated, which will ultimately increase the profit of farmers.

- There is need for modernizing the quality control laboratories of the State Government, apart from need for strict laboratory inspection of meat and meat products, training programs for meat workers regarding hygiene and sanitation need to be organized regularly.

- Modernization of abattoirs, setting up of rural abattoirs and registration of all slaughter houses in cities/towns are essential for quality meat production.

- The setting up of large commercial meat farms have been recommended to address the traceability issues necessary for stringent quality standards of CODEX.

Way forward

- In a report titled the ‘Indian Meat Industry Perspective’, the FAO outlined four steps that should be taken if India’s food industry is to successfully go pink. These recommended steps were:

- setting up state of the art meat processing plants;

- developing technologies to raise male buffalo calves for meat production;

- increasing the number of farmers rearing buffalo under contractual farming;

- establishing disease-free zones for rearing animals.

- Production of good quality animals for slaughter is essential for the production of good quality meat. Hence, farmers’ cooperative can play a major role in the field of production and marketing of quality animals, extension education and encouragement of backward integration/contract farming.

- Cold chain infrastructure to store the processed meat should be developed at town levels.

- Maintain food safety at all stages of production, processing, packing, storage and marketing of meat and meat products, and adherence to standards which are prescribed by the importing countries.

- Priorities must be given to address the myths prevalent among the public regarding meat consumption and diseases with proper extension programmes.

- Meat processing and value addition are key to the prosperity of the meat industry. The awareness regarding the processed meats and the convenience to the consumers and households should be improved.

- In general, meat sold in India is in unpacked form. Meat is packed only in certain organized meat factories. For sanitary and secure delivery of the meat and various value-added meat products through the various stages of processing, storage, transport, distribution and marketing, the packaging is of utmost importance.

- It is, therefore, necessary to establish modern slaughter-houses to bring improvements in meat-handling practices, recovery and proper utilization of by-products, waste treatments for pollution control to reorganize.

- There is also a need to strengthen the meat industry on scientific line to provide wholesome and safe meat to domestic consumption as well as to play a substantial role in international meat trade/market.

Being a secular country, the focus should be more on professional aspect of market rather than religious aspect. India needs legislations and willingness to make India fair play ground not only for domestic entrepreneurs but also for global players in meat and poultry business.

Why is India a Favorable Destination for Poultry and Food Processing Industries?

- India is the fastest growing economy in the world.

- It is the largest producer of agricultural commodities.

- It has the second largest consumer market globally.

- India has significant investments in world class ports, logistics, and supply chain infrastructure.

- Proactive government policies.

- Investor-friendly incentives.

- Highly skilled manpower.

Advantages of Starting Meat and Poultry Production in India

- India has the world’s largest population of livestock.

- India produces around 5.3 million metric tons of meat and 75 billion eggs annually.

- India is the largest producer of buffalo meat and the second largest producer of goat meat.

- The current processing level in poultry is 6% while it stands at 21% for meat.

- Poultry is a highly integrated industry.

- The country is on par with the efficiency levels of many western countries.

- The government of India has taken steps for modernization of municipal slaughter houses to provide safe and hygienic meat to consumers.

- Export-oriented units have invested significantly in the establishment of large slaughter houses-cum-meat processing plants laden with the latest technology.

- Farm automation, slaughter houses, logistics, and point-of-sale cold storage infrastructures are amazing growth avenues in India given the changing preference of Indian consumers for clean, safe, and hygienic meat products.

There are about 27 modern meat processing plants (approved after due inspection) for the export of meat. All export oriented units (EOU) are registered with the Agricultural and Processed Food Products Export Development Authority (APEDA) of India.

Opportunity in Poultry and Meat Sector

The table below outlines the growth opportunities for the ‘technology and equipment suppliers’ and ‘poultry industry players’.

| Technology and Equipment Suppliers | Poultry Industry Players |

| New technologies in meat and poultry processing. | New products that add value such as frozen products, RTC/RTE, and snacks. |

| Cold chains. | Egg powder plants. |

| New veterinary technologies and services. | New feed formulations. |

| Food testing labs. | Hatcheries. |

Challenges Faced by the Meat Industry in India

One of the major challenges is improving the productivity of farm animals. The average annual milk yield of Indian cattle is 1172 kg which is only about 50 per cent of the global average. The frequent outbreak of infections like the foot and mouth disease, black quarter infection, and influenza severely impacts livestock health and lowers productivity.

The next problem is the generation of greenhouse gases by the humongous population of herbivorous animals in India. Reducing the emissions through mitigation and adaptation strategies is a major challenge.

Crossbreeding of indigenous species with exotic stocks to enhance the genetic potential of different species has been successful only to a limited extent.

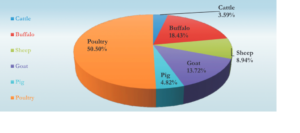

A breakdown of meat production trend in India.

Unregulated meat markets, tropical climate, inadequate slaughterhouse hygiene measures, and the lack of surveillance of meat-borne diseases enhance the risk of health-related and occupational hazards. According to research, there are about 8000 registered and more than 20,000 unregistered slaughterhouses in the country and most of them are devoid of basic amenities like light and ventilation. Moreover, the slaughtering and carcass-dressing processes are performed in open areas in highly unhygienic conditions following which the meat is sold with little or no veterinary inspection.

Finally, the meat production segment is largely unorganized. Traditional production systems and disorderly practices have spoilt the reputation of the Indian meat industry.

More about the Meat Industry in India

While India has an abundant supply of meat, the meat processing industry is yet to catch up. Meat processing covers a spectrum of products. It includes animal husbandry, poultry farm produce, bulk frozen meat, chilled and deli meat, packaged meat, and ready-to-eat processed meat products.

There is immense scope for meat processing in poultry. In fact, the poultry industry has made considerable progress by developing and marketing value-added products. The meat industry is slowly yet steadily catching pace on the global front with India now exporting both frozen and fresh chilled meat to more than 60 countries.

The major item of export is de-boned frozen buffalo meat which accounts for 97 per cent of the total meat export. The major markets for Indian buffalo meat are Malaysia and Egypt while for sheep meat and goat meat, the markets are UAE, Iran, and Jordan. India also exports a small quantity of processed meat to Thailand, Yemen, and Japan and some poultry products to Saudi Arabia, Oman, Kuwait, and Qatar.

The Future of Meat Industry

Raising animals that are in good health is essential for the production of good quality meat. Farmers’ cooperatives can play a major role in the nourishment and marketing of hale and hearty livestock. They can also encourage backward integration/contract farming. Above all, if the Indian meat industry wants to achieve global recognition, the maintenance of food safety at all stages of production, processing, packing, storage, and marketing of meat and meat-derived products while adhering to the standards prescribed by the importing countries shall make a significant impact.

The livestock population of any country is a deciding factor for its meat production potential besides societal barriers, traditions, customs and preferences of its natives. Thus, the sustainability of the livestock sector is a decisive factor in the sustainability of the meat industry. As far as India is concerned, it is bestowed with a huge livestock population (Table 1) that plays a pivotal role in the Indian economy. The cattle and buffalo population of India is about 13% and 42.61% of the global population, respectively sharing more than 50% collectively of the total world population that are generally reared in rural areas by small, marginal, or landless labourers. The large ruminants are mostly reared for milk production, though after their full utilization of dairy life, mainly buffaloes are meant for meat production. However, their utilization as draught animals have gone down due to progressive mechanization. The small animals (ruminants and non-ruminants) like sheep, goats and pigs are reared mainly for meat production. The other products obtained from sheep and goats are fiber/wool and milk.

Table 1: Livestock population in India as per 20th Livestock Census (Source: BAHS, 2020)

| Species | Population (Million Numbers) 2012 | Population (Million Numbers) 2019 |

| Cattle | 190.90 | 192.52 |

| Buffalo | 108.70 | 109.85 |

| Total bovines | 299.6 | 302.3 |

| Sheep | 65.07 | 74.26 |

| Goat | 135.17 | 148.88 |

| Horses and ponies | 0.63 | 0.34 |

| Camels | 0.40 | 0.25 |

| Pig | 10.29 | 9.06 |

| Mules | 0.20 | 0.08 |

| Donkeys | 0.32 | 0.12 |

| Yak | 0.08 | 0.06 |

| Mithun | 0.3 | 0.4 |

| Total Livestock | 512.06 | 535.82 |

| Poultry* | 729.21 | 851.81 |

*Poultry includes chicken, ducks, turkey and other birds

As per the latest report of basic animal husbandry statistics, the livestock population has shown an increase of 4.82% from 2012 to 2019 and among different species of livestock, sheep showed a maximum increase (14.13%) followed by goats (10.14%), cattle (1.34%) and buffalo (1.06%). However, a major decline was observed in pigs (-12.03%). The % share of India and the ranks India holds in terms of different species’ population on global front have been illustrated in table 2 along with the names of the state that tops in the species population.

Table 2: Status of the Indian livestock sector on the global front

| Species | % Present in India | Rank | Top producer state |

| Total Livestock | 10.59 | 1st | |

| Cattle | 12.5 | 2nd | West Bengal |

| Buffalo | 56.7 | 1st | Uttar Pradesh |

| Sheep | 5.6 | 3rd | Rajasthan |

| Goat | 13.34 | 2nd | Rajasthan |

| Pig | 1.33 | – | Assam |

Meat production in India

In terms of total meat production, India ranks 5th globally with the production of 8.60 million tonnes of meat in 2019-20. In 2020-21, meat production has increased to 8.80 million tonnes (BAHS, 2021). The Indian meat industry has exhibited steady growth in terms of meat production in the last decade as illustrated in figure 1. However, the annual growth rate has not been seen following any particular trend. The annual growth rate of Indian meat production in 2019-20 was estimated as 5.98% which was 5.99% in 2018-19. The contribution of different states to the total Indian meat production varies depending upon the livestock population. Uttar Pradesh was the top meat producing state in the country in 2019-20, producing 13.56% of total meat production in the country, followed by Maharashtra (13.26%) and West Bengal (10.50%).

Figure 1: Total meat production of India in the last decade (BAHS, 2020)

The contribution of different species to total meat production has been exhibited in figure 2 which indicates the highest contribution of buffalo meat among different livestock species followed by goat, sheep, pig and cattle. Half of the total meat production is contributed by poultry alone. However, the meat availability in India is only about 15g/person/day against the ICMR recommendation of 30g/person/day and per capita, world meat consumption is 43kg/annually. Per capita meat availability in India in 2019-20 was 6.45kg/annum. India’s meat consumption is very low – currently 4.5 kg per capita – and it has grown by only 1 kg in the last 20 years.

Figure 2: Species-wise meat contribution across the country (BAHS, 2020)

Concerned meat polices

Slaughter and processing: The slaughter and processing of animals for domestic use is regulated by the Food Safety and Standards Authority of India (FSSAI) employing the Food Safety and Standards Rules and Regulation (2011).

Export: Agricultural and Processed Food Products Export Development Authority (APEDA) of India regulates the export of meat. APEDA is an apex body that promotes India’s export trade in food and agricultural products (including fresh fruits and vegetables, processed food products, livestock products, and cereals). It is an agency of the Ministry of Commerce and Industry. Only that meat from India can be exported which has been produced and processed in the APEDA registered abattoirs and meat processing plants and that too after compulsory microbiological and other testing. A regular animal health checkup by the respected state veterinary officer is mandatory for which the establishment submits an online request to the respective state animal husbandry office. The veterinary officer issues the animal health certificates to the registered processing establishment after a proper checkup. India exports primarily frozen (halal) boneless carabeef, which is typically thawed, and resold in wet markets. India ranks first in terms of buffalo meat export. About 111 modern meat plants have been registered with APEDA having HACCP and ISO 22,000 certification (APEDA, 2020)

Import: An importer must first obtain an import license from the Director-General of Foreign Trade (DGFT). The import request is reviewed and approved by the Ministry of Fisheries, Animal Husbandry and Dairying/Department of Animal Husbandry and Dairying after conducting the risk analysis. The import of livestock products is governed by an “open general license” (OGL). The import of meat is regulated under Section 3 and Section 3A provisions of the Livestock Importation Act, 1898 by Department of Animal Husbandry and Dairying to prevent the entry of exotic diseases. Recently, DAHD has come up with a new regulation for imported products that implies the occasional inspection of products by Animal Quarantine and Certification Services (AQCS) officials.

Trade: Trade of meat is regulated by the Ministry of Commerce and Industry (MOCI) of India along with the trade of other livestock and livestock products trade.

Steps initiated to boost the growth of livestock sector

As per recent report published in 2021, various schemes offered by the Department of Animal Husbandry and Dairying have recently been merged into three broad categories as Development Programs, Livestock Health and Disease Control and Infrastructure Development Fund. (Mani et al., 2021). A special package of approx. $1.32 billion for livestock sectors has been released over the five years from 2021 to 2026. The schemes that got merged under these categories include:

- Development Programs: Rashtriya Gokul Mission, National Program for Dairy Development, National Livestock Mission and Livestock Census and Integrated Sample Survey as sub-schemes

- Livestock Health and Disease Control: Livestock and Disease Control Scheme and National Animal Disease Control Program

- Infrastructure Development Fund: the funds of animal husbandry and dairy infrastructure fund have been merged

Further, FMD is the most critical disease for India to manage to boost meat export for which India has a World Organization for Animal Health (OIE)-endorsed official program (initiated in May 2015) for controlling the disease. Recently in 2019, India’s Union Cabinet has approved a new scheme in the National Animal Disease Control Program (NADCP) to eradicate the foot-and-mouth disease and brucellosis outbreaks by 2030. Through this program, the entire susceptible population of bovines, as well as small ruminants and pigs are required to vaccinate at a six-month interval.

Future prospects of meat industry ————–

Strategies for the prosperity of Indian meat industry: Production of good quality animals for slaughter is must for production of good quality meat. Hence, farmers’ cooperative can play a major role in the field of production and marketing of quality animals, extension education and encouragement of backward integration / contract farming as in poultry industry for intensive and semi-intensive system of rearing small ruminants. Food safety at all stages of production, processing, packing, storage and marketing of meat and meat products, maintenance of standards such as SPS, HACCP certification and others which are prescribed by the importing countries. Consumer awareness: Priorities must be given to address the myths prevalent among the public regarding meat consumption and diseases (Meat consumption and risk of cancer, Meat consumption associated to increased risk of coronary heart disease due to its fat and cholesterol content) with proper extension programmes. Meat processing and value addition are key for the prosperity of meat industry. The awareness regarding the processed meats and the convenience to the consumers and households should be improved. Packaging of meat and meat products: Most of meat is sold in India is in unpacked form. Meat is packed only in some organized meat factories and in bacon factories. For safe delivery of the meat and various value added meat products through the various stages of processing, storage, transport, distribution and marketing packaging is of utmost importance. Breeding strategies: Meat scientists and animal geneticists should collaborates their research for developing a potential cross bred buffalo for meat purpose. Meat production potential under extensive and intensive system should be adequately exploited through cross breeding of selected local breeds/ nondescript breeds with specific exotic and improved breeds. At present buffalo meat is obtained as a byproduct of buffalo milk production. There is vast scope for increasing carabeef export consequent to cattle slaughter ban act, availability of male buffalo calves and the steady demand for the same from the importing countries. It is high time to consider growing/fattening of male buffalo calves for veal production. Sufficient nutrition and improved levels of hygiene and sanitation at meat handling will enable India a quantum jump in meat production by utilizing the surplus male calves. Meat sector plays an important role in India as it not only provides meat and by-products for human consumption but also contributes towards sustainable livestock development, employment, developed secondary industries and livelihood security for millions of men and women from weaker sections. Major portion of meat from sheep, goat, pig and poultry is primarily used for domestic consumption in the form of fresh meat. Certain portion of meat from buffaloes, cattle and sheep is exported in frozen and chilled form. Meat production and supply of meat for local consumption is the most neglected sector in the country. Meat is sold in open premises leading to contamination from dirt, dust, flies and other pollutants. The traditional production systems and the unorganized practices have ruined and flawed the image of the Indian meat industry. Indian meat industry on scientific and mechanized lines is need for benefiting livestock producers, processors and finally consumers. Indian meat contains less fat and the present international trend is favourable for low fat meat. Average fat content of Indian meat (buffalo/poultry) is around 4% compared to 15-20% in most of the developed countries. Moreover, meat is free from growth promoters of other therapeutic residues and mad cow disease, which favours Indian meat in international trading.

Conclusion

India, being bestowed with a huge livestock population, has great potential to sustain a viable meat industry. Further, many steps have been taken along the same lines to boost the industry. The organized broiler industry, where animals would be grown specifically for meat purposes is the speculated future of India.

PPT ON INDIAN MEAT INDUSTRY

DR. DINANATH PANDEY, PUNE

References——-

APEDA. (2015). Export of agro and processed food products including meat and meat products. Agricultural and Processed Food Products Export Development Authority. Ministry of Commerce, Government of India. DHADF, Department of Animal Husbandry, Dairying & Fisheries, Ministry of Agriculture, Government of India, New Delhi Annual Report, 2016-17. Lawrie, R. A., Ledward, D. A. (2006). Lawrie’s Meat Science (7th ed.). Cambridge: Woodhead Publishing Limited. ISBN 978-1-84569-159-2. McArdle, John. (2013). “Humans are Omnivores”. Vegetarian Resource Group. Truswell, A. S. (2002). Meat consumption and cancer of the large bowel. Europeoan Journal of Clinical Nutrition, 56, S19- S24.

IMAGES-CREDIT GOOGLE