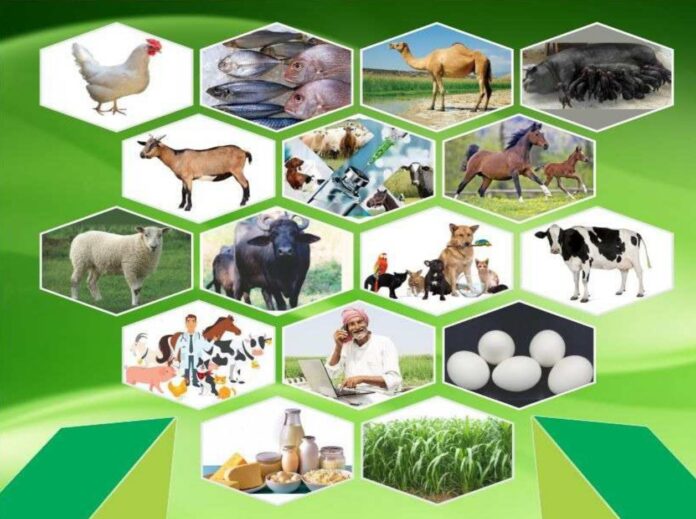

The Use Of Post-Mortem Report In Cattle insurance claim : Bird’s eye view Analysis

Of the livestock insurance products in India, 90 per cent are delivered through the bank assurance model with financial institutions such as cooperative banks, commercial banks and microfinance institutions serving as distribution channels. Since 1971 the Indian Government has catalysed the livestock insurance market through the Small Farmers’ Development Agency, which has introduced various schemes for livestock-rearing farmers by providing funding for the purchase of livestock through loans and a premium subsidy for the insurance cover. In 2005-06 public insurers covered approximately 80 per cent of the 7.9 million insured cattle. Despite their market dominance, public insurers have introduced few modifications in product design. In 2007, after the insurance regulator removed the restrictions on premium rates, six private insurers entered the livestock insurance market (Ruchismita and Churchill, 2012). Livestock insurance in India has a history of high claims ratios. While it is difficult for private insurers to get historic claims data, it is acknowledged that public insurers frequently experience claims ratios of 150 to 350 per cent. A major reason for fraud is the difficulty in identifying whether the animal in the claim is the insured cattle. At enrolment insurers provide farmers with plastic tags to clip to the ear of the cattle. Often the process is not monitored and the farmer may not tag the cattle at all, effectively allowing the household to insure the full herd for the cost of one animal by simply filing a claim for the first cattle that dies. Alternatively, farmers may cut the tagged ears of live animals and submit them for claims. Fraud can also be conducted by the distribution channel. If the cattle loan is used for a purpose other than to buy cattle, bank staff may retain the tag for this “paper cow” and submit it for a claim in the event of the death of an uninsured animal. Veterinarians can be accessories to fraud by providing false death certificates for a fee (Ruchismita and Churchill, 2012). Even in genuine loss cases it can be difficult to verify whether the death was due to reasons covered in the policy, because insurers receive notification of the claim several days after the event, by which time the farmers have already disposed the carcass.

Issue of Post-Mortem Reports and Documents for Insurance Claims

The aim of the scheme is to provide access to citizens to request Veterinary Officers for issue of Postmortem Reports of insured animals and related documents for settlement of insurance claims of livestock.

DOCUMENTS REQUIRED FOR PROCESSING OF CLAIMS:

- Copy of the intimation of death of animal by the beneficiary

2. Post Mortem Report

3. Veterinary Certificate

4. Claim Settlement Document signed by the Farmer

5. Identification Proof (Copy of the Aadhaar Card)

6. Two Photographs of deceased animal

7. Policy number of the insured animal

8. Bank A/C No. with IFS Code of the Policy Holder for DBT (Photocopy)

9. Ear tag issued to the animal.

Claim due to Death of Cattle (Non – IRDP)/ Permanent Total Disablement

Xerox copy of intimation of death/loss to company alongwith copy of insurance policy and premium receipt

Duly filled Claim Form

Death Certificate/Post Mortem Report from Veterinary Doctor

Panchnama & Sarpanch’s report

Ear Tag

1.CATTLE INSURANCE POLICY CLAIM FORM

2 Cattle Insurance Policy

3.CATTLE INSURANCE

4.ICICI Lombard Cattle Insurance Policy

5.IRDA HANDBOOK FOR LIVESTOCK INSURANCE IN INDIA

6.SHEEP AND GOAT SUKSHMA BIMA POLICY -NIACL

CATTLE INSURANCE POLICY CLAIM FORM

ICICI Lombard Cattle Insurance Policy

IRDA HANDBOOK FOR LIVESTOCK INSURANCE IN INDIA

SHEEP AND GOAT SUKSHMA BIMA POLICY -NIACL